On 30 November 2021, HMRC published their draft UK Mandatory Disclosure Rules and released their consultation which seeks views on the design of the draft regulations. The consultation will be open until 8 February 2022.

At the Spring Budget 2021, the UK Government announced that it would implement Mandatory Disclosure Rules(MDR)(2.14). The rules are intended to replace the similar EU DAC6 rules which were implemented in the UK prior to their exit from the European Union. The draft regulations draw closely to the OECD’s Model Mandatory Disclosure Rules for CRS Avoidance Arrangements and Opaque Offshore Structures.

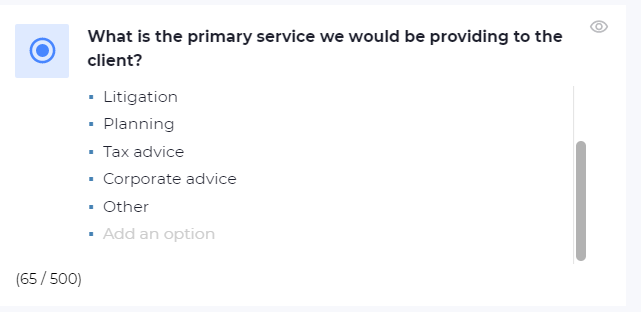

MDR requires advisers (and sometimes taxpayers) to report information to the tax authorities on certain prescribed arrangements and structures including those that could circumvent existing tax transparency reporting rules known as the Common Reporting Standard or hide ownership of assets.

VinciWorks will be hosting a webinar in the coming weeks with representatives from HMRC to discuss the consultation.