DAC6 legislation in Malta requires that an intermediary who is exempt from reporting in Malta (such as those who rely on legal professional privilege) must provide the Commissioner for Revenue with an annual updated situation including a list of the reportable cross-border arrangements that were not reported.

On 11 November 2021, the Maltese Commissioner for Revenue announced that the deadline for the notification needs to be submitted by 28 February 2022 for all transactions where the triggering event was met by 31st December 2021.

The annual notification form can be accessed here.

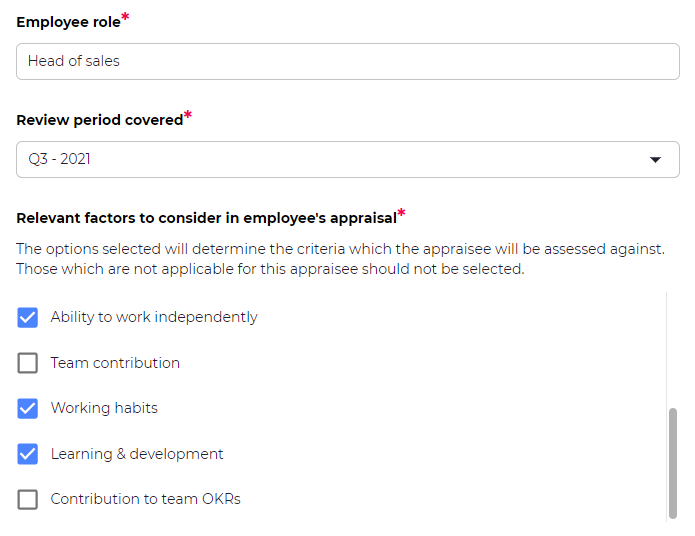

VinciWorks’ DAC6 Solution offers a tracking, auditing and reporting solution for all firms in Malta. Get in touch with us to see how Omnitrack can help ensure you are completing your reporting requirements.