On June 4, 2021, The Cyprus Tax Department announced that they will not begin to impose administrative fines for late DAC6 submissions if they are reported to the Tax Administration by September 30, 2021.

The relaxation of penalties will apply to:

- Reportable cross-border arrangements that have been made between 25 June 2018 and 30 June 2020 and had to be submitted by 28 February 2021.

- Reportable cross-border arrangements that had been made between 1 July 2020 and 31 December 2020 and had to be submitted by 31 January 2021.

- Reportable cross-border arrangements made between 1 January 2021 and 31 August 2021.

VinciWorks’ DAC6 Solution offers reporting solutions for international firms for MDR regulations in many jurisdictions including Cyprus.

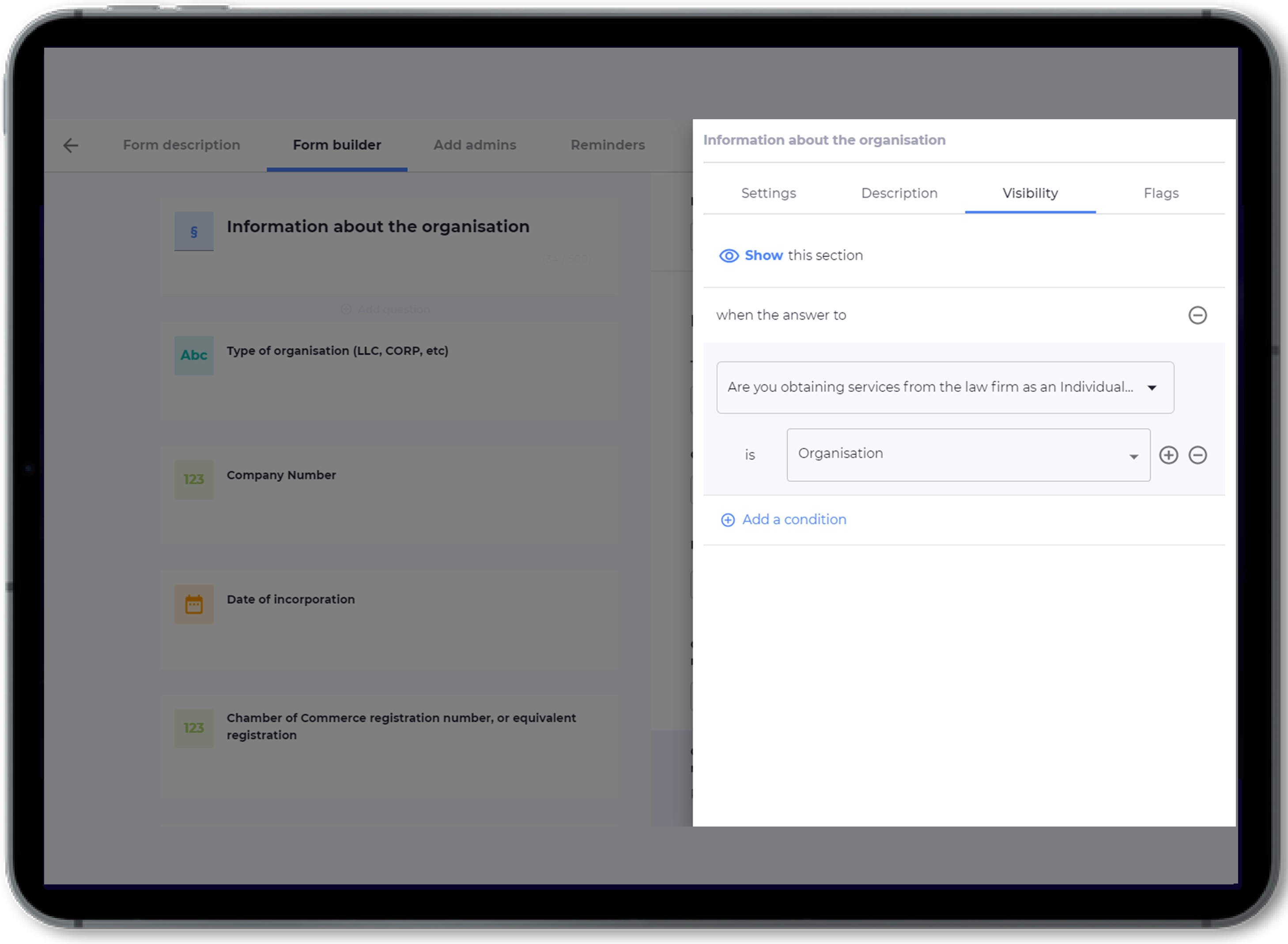

Get in touch with us to see how Omnitrack can help ensure you are completing your reporting requirements.