World leaders likely to make more ESG reporting mandatory

COP26 might be experiencing its own logistics problems, with delegates queuing for hours to get in and a foreign energy minister unable to access the venue because she is a wheelchair user, but the early spotlight at the conference has fallen on supply chains. Already one of the key takeaways from the global climate summit in Glasgow will be a need for businesses to pay much closer attention to supply chain due diligence as countries commit to more mandatory ESG reporting.

World leaders agreed a significant deal to tackle deforestation, committing billions of funding to restore degraded land, protect forests and mitigate damage. The UK is already pushing ahead with regulation to tackle deforestation. The Environment Bill currently going through parliament includes provisions to require large companies to undertake supply chain due diligence and report on the risks of deforestation in their supply chains.

The Glasgow Leaders’ Declaration on Forest and Land Use was signed by over 100 leaders and will commit £14bn of public and private funds to protect 85% of the world’s forests. A further 28 countries have committed to remove deforestation from high risk products such as palm oil, soya and cocoa. More than 30 of the world’s largest companies have committed to end investment in activities linked to deforestation.

The spotlight on business, and supply chains in particular, has been a key feature of the early part of the summit. Climate activists set out their demands for what world leaders should be striving for at the summit. In a letter signed by Greta Thunberg and other activists, they called for an end to ‘creative carbon accounting’. They have demanded that businesses publish emissions data not just about themselves, but from within their supply chains as well.

What new regulations have already been announced?

Ahead of COP26, the UK announced they will become the first country to mandate TCFD disclosures from April 2022. The Taskforce on Climate-Related Financial Disclosures (TCFD) is an environmental reporting framework which helps companies report consistent climate risks and opportunities. This new law is perhaps one of the most significant ESG-related mandatory disclosure rules to yet be introduced.

The first few days of COP26 have seen not only UK business, but companies around the world being pressured, and potentially mandated, to take a closer look at their supply chain. From measuring emissions to reporting on deforestation risks, governments expect business to take a leading role in getting to net-zero. The supply chain is likely to be a key battleground in understanding the impact and risks of climate change.

But it’s not only environmental factors in the supply chain businesses should be concerned about. The EU is moving ahead with their corporate due diligence and corporate accountability directive, which will require businesses to identify, address and remedy their impact on human rights and social aspects of ESG due diligence.

Will compliance go beyond the climate?

The International Financial Reporting Standards (IFRS) Foundation are keen to set sustainability reporting standards which will go beyond climate-related disclosures. Material non-climate ESG issues such as human rights, diversity, equality and health and safety are becoming ever more relevant for companies and will need comparable reporting standards.

With the early spotlight on the impact of supply chains, it seems countries will follow the UK’s lead by mandating more disclosures, alongside the adoption of ESG reporting standards like TCFD and potentially the new Taskforce on Nature-related Financial Disclosures (TNFD) reporting frameworks, specifically designed to protect the natural environment.

What do I need to know about COP26 and business?

There’s already been a raft of regulatory announcements around COP26, which will significantly impact compliance for years to come.

VinciWorks is hosting a webinar on 17 November to dissect and discuss international commitments and new areas of regulation following the COP26 summit in Glasgow. Joining us for this webinar will be James Alexander, Chief Executive of the UK Sustainable Investment and Finance Association. As well as the impact of COP26, we’ll hear from James about ethical investing and how businesses can set themselves apart through net-zero commitments and ESG compliance. You can also listen again to our previous webinar on ESG: a new era in corporate accountability.

The webinar will cover:

- Current environmental regulations for businesses and what might change

- The impact of COP26 on compliance

- How companies can work towards net-zero

- Understanding ESG reporting and preparing for ESG regulation

- Setting up an environmental compliance programme

How can I assess my supply chain for climate risks?

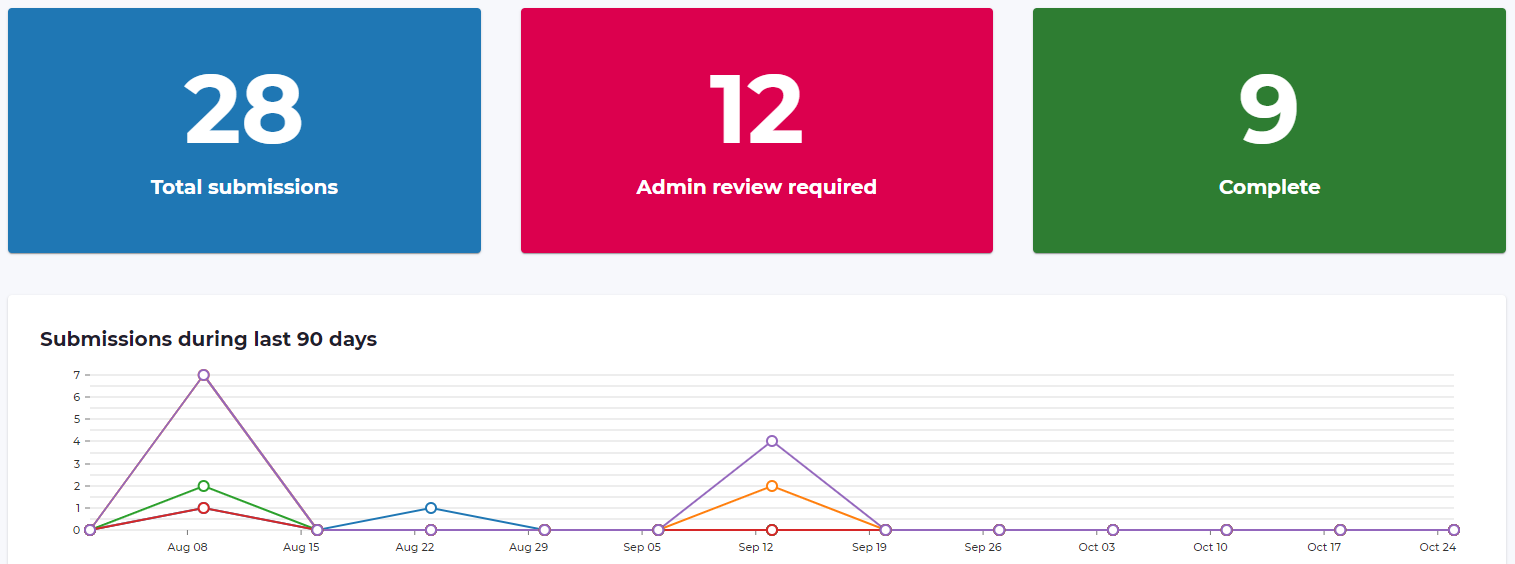

Supply chain due diligence is crucial for compliance. Supply chains can be complicated, stretching across multiple countries and dozens of third parties. But VinciWorks can help simplify the process with our Supplier Onboarding Compliance Solution. Using our Omnitrack system, vendors can be quickly and simply onboarded and reported on at the touch of a button. Pre-built forms include a range of ESG factors including environment, climate change, modern slavery and anti-bribery and corruption.

- Our central database allows you to track and record all supplier information in one place, avoiding lost or missing data

- Use one dynamic form that adapts the question set depending on the profile of the supplier and the responses submitted

- Easily understand the data and identify risks via a graphical dashboard

- Complex compliance requirements are hard to get right. We offer best practice workflows developed with leading law firms ensure full compliance with regulatory needs.

- Automated flagging and sorting surfaces high-risk submissions and escalates via email where needed, allowing multiple stakeholders to review data

- API functionality allows you to integrate data with external data sources

Contact us on the form below to learn more about our Supplier Onboarding Compliance Solution. You can also download our Supplier Risk Assessment guide directly.