Omnitrack version 2.84.0

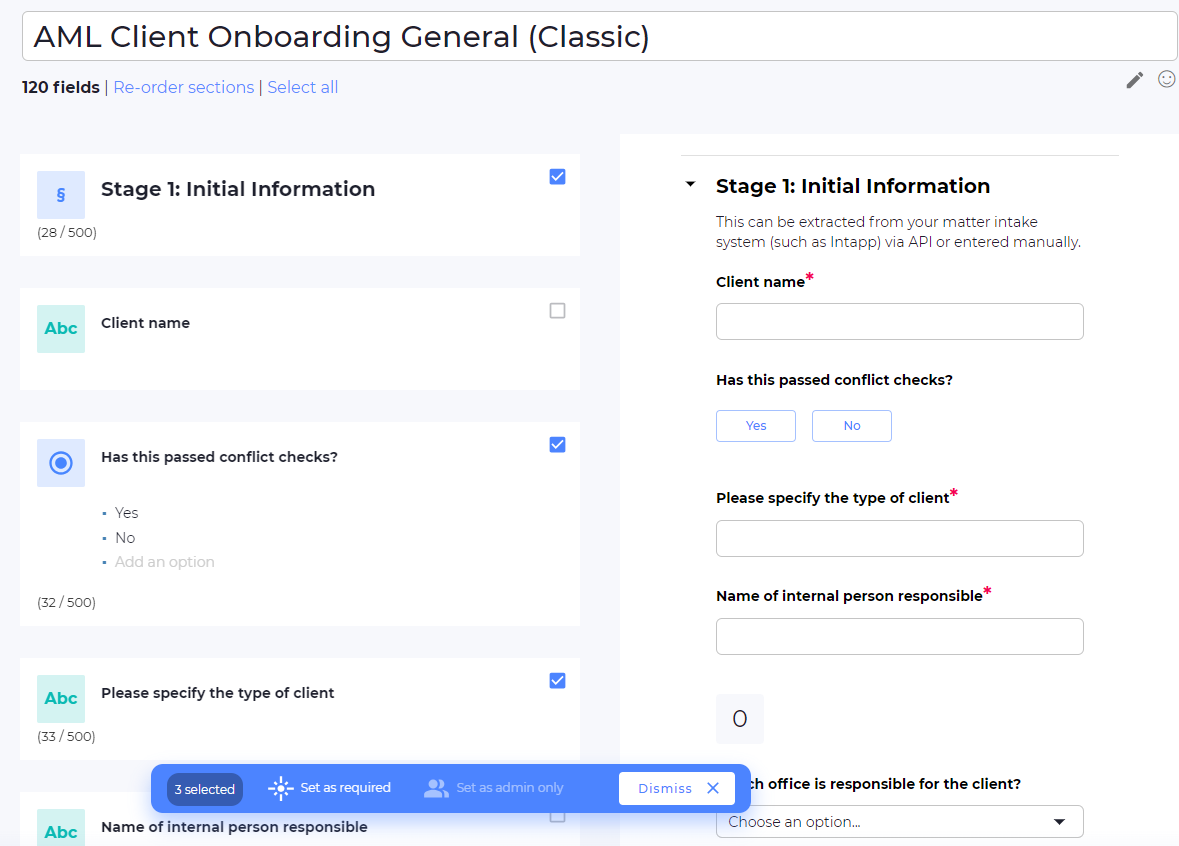

Design improvements to the form builder! With the latest release, you can now perform bulk actions with ease. Simply select multiple fields, and a new intuitive bulk action menu will appear, enabling you to mark them all as required or set their permissions to admin-only. Say goodbye to repetitive tasks and hello to increased efficiency! […]

New guide – Manual Handling at Work: A Guide to Compliance

In the last year in the UK, there were over 78,000 reportable injuries at work in the last year. At least 2 million sick days are taken because of back pain – two thirds of which could have been avoided through the use of safe manual handling techniques. Most manual handling injuries actually do not […]

The Solicitors Regulation Authority wants to know how law firms are handling the sanctions regime

It’s time to look at how your firm handles designated persons The Government’s financial sanctions regime is continually changing. It was created with national security objectives in mind and law firms play a critical role in its implementation. So much so that the sanctions regime applies to all firms that provide legal services, a broader […]

AML Case Study: Credit Suisse found guilty in money laundering case – understand what went wrong

Global investment bank Credit Suisse and a former employee were found guilty in a Swiss federal criminal court of failing to prevent money laundering, in a case that should serve as a wake up call for Swiss banks and financial institutions worldwide. In our new series of AML case-study one-pagers, VinciWorks has produced an insightful […]

VinciWorks is offering a free SRA diversity reporting tool

The Solicitors Regulation Authority (SRA) has announced that its mandatory diversity survey will be due sometime in the summer of 2023. The SRA has said that it will provide four weeks’ notification prior to the actual deadline. VinciWorks is proud to offer all law firms in England and Wales a simple, free and secure way to […]

Members’ Update – 28th April 2023

Domestic abuse lived experience, neurodiversity guide, upcoming intersectionality course and MySkillBoosters learning platform.

Lesbian Visibility Week

By participating in Lesbian Visibility Week you will be demonstrating to your employees and customers that you actively support the LGBTQI+ community.

Partner receives £32,000 fine secretly working on a deal with his firm on the opposite side

An experienced partner who secretly worked on the purchase of a property where his firm was acting for the seller has been fined £32,000 for a lack of integrity. 1 DON’T BUY DRUGS FROM YOUR CLIENT! This is definitely not advice we ever expected to be putting in here! However, a barrister has recently pleaded guilty […]

SRA Diversity Survey 2023 – What You Need to Know

Updated 1 June 2023 The Solicitors Regulation Authority (SRA) has announced that its mandatory diversity survey will be due in the summer of 2023. The SRA will open the survey on 26 June when they will email firms with a link for reporting. The SRA has given a reporting period of four weeks – the […]