A recent report estimated that 27.7m UK adults could be considered to be living in vulnerable circumstances, an increase of 15% in just a few months, with 2021 expected to show a further increase. This equates to 53% of the UK adult population – i.e., more than half.

Who are the vulnerable customers?

A vulnerable customer is someone who, due to their personal circumstances, is especially susceptible to harm, particularly when a firm is not acting with appropriate levels of care.

The FCA expects firms to demonstrate how they are ensuring vulnerable customers are treated fairly. This includes recording and monitoring to ensure the service provided to vulnerable customers is as good as those provided to other customers.

What is a vulnerable customer example?

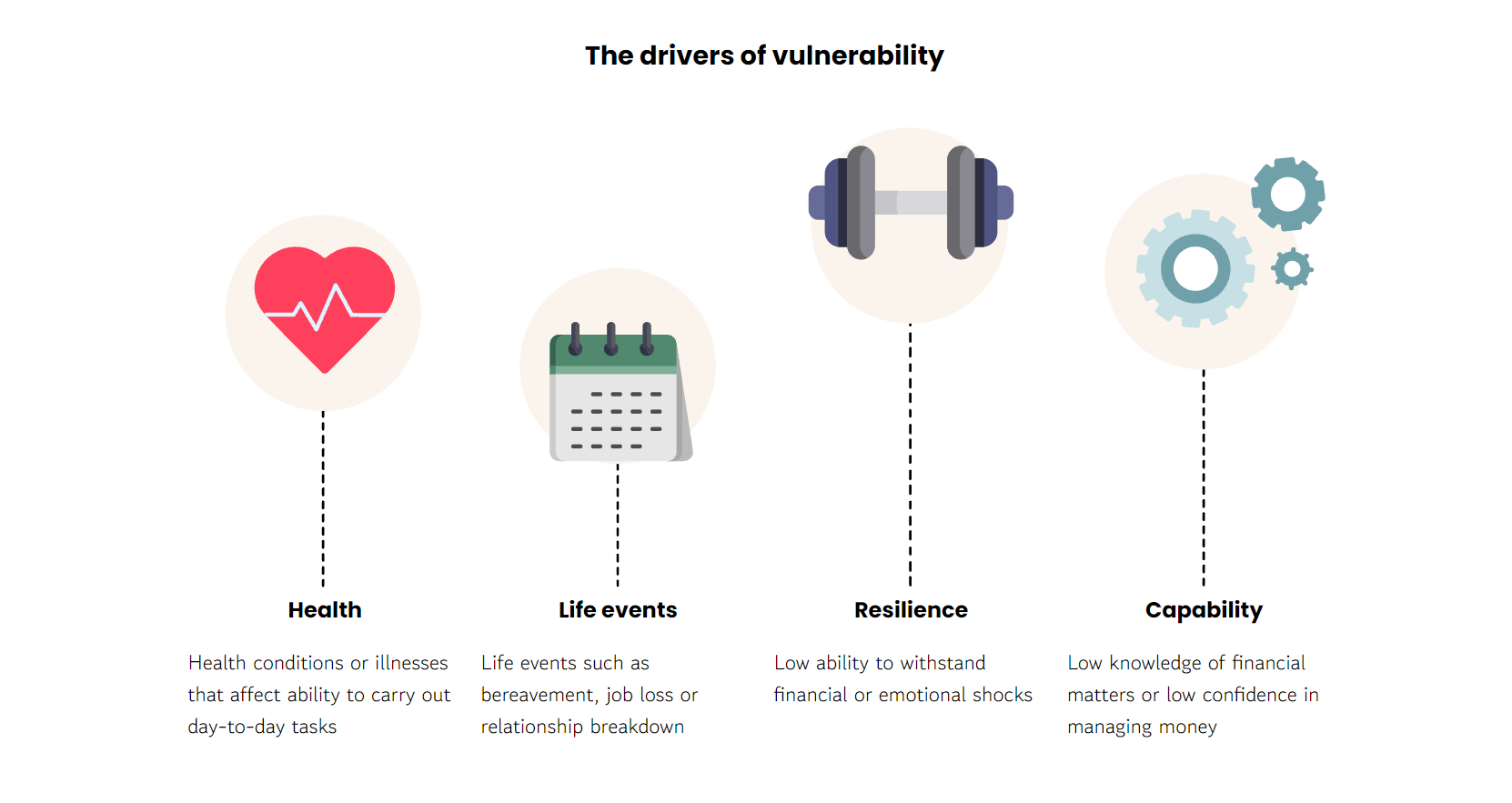

Being vulnerable is not necessarily a life-long state: it can be long term, short term, or permanent. Vulnerability drivers could include the following examples:

- Health – health conditions or illnesses that affect ability to carry out day-to-day tasks.

- Life events – life events such as bereavement, job loss or relationship breakdown.

- Resilience –low ability to withstand financial or emotional shocks.

- Capability – low knowledge of financial matters or low confidence in managing money

Who do the FCA consider to be particularly vulnerable?

Certain life events can trigger additional or increasing vulnerabilities. Consumers who already have lower financial literacy or capacity may be even harder hit and unable to manage their finances.

How do you assist vulnerable customers?

You need to understand your customer base and target market so you can correctly identify potentially vulnerable consumers and those who are more likely to require support.

For example, if you advise on pensions or life insurance, your customer base is likely to be older. You must be more alert to signs of illness or disability.

You must also be aware of how your actions or inactions could increase vulnerability and cause harm. For example, not offering a customer who loses their source of income appropriate forbearance measures could lead to greater stress and anxiety, which in turn leads to the customer taking actions which are more harmful such as borrowing more to cover shortfalls.

The FCA expects your firm to have procedures in place to identify vulnerable customers, including if they access your services digitally, and to know how to respond appropriately.

VinciWorks new course: Vulnerable customers in financial services

Our new course, Vulnerable Clients in Financial Services, teaches users what makes people vulnerable, what the signs and characteristics of vulnerability are in specific target markets and customer bases, and how to provide an appropriate level of care to vulnerable customers.

Learning outcomes

In the course, users will learn:

- How to identify vulnerable customers and understand their needs

- What one’s obligations are to ensure vulnerable customers are treated fairly

- How to meet obligations under the Principles for Businesses

- Best practice for dealing with vulnerable clients in a variety of situations

Course features

- New, clean, user-friendly scroll design

- Eye-catching animations and video content

- Fully customisable

- A wide range of scenarios to help learners apply what they have learned

- Learner assessment section

- Option to integrate with Omnitrack, our flexible data collection and reporting tool