Details of the extension of the trust registration service under the Fifth Directive

On 24 January 2020, HMRC launched their promised technical consultation on changes to the Trust Registration Service (TRS) to be made under the Fifth Anti-Money Laundering Directive.

The changes will focus on the registration requirements of all UK and many non-EU resident express trusts, whether or not they incur a UK tax consequence. This could extend the number of registrable trusts from around 200,000 to over two million.

The technical consultation will examine the scope of trusts that will be required to register, as well as the penalty regime for non-compliance.

What does HMRC suggest regarding trusts?

The purpose of the Fifth Directive trust provisions is to counter the risk of money laundering through these instruments. The TRS was created as a result of the Fourth Directive to register tax-paying trusts and estates. Any trusts required to register currently should continue to do so.

While the Fifth Directive requires all express trusts to register, the government recognises that in many cases, a trust created through the intention of the settlor will be implied by law, and therefore the beneficial owners will not necessarily be aware the trust exists. There are also a small number of cases where a trust arises directly from the operation or requirement of statute, such as managing assets for the benefit of vulnerable individuals.

The government stated in the consultation document that implied trusts do not meet the definition of express trusts, and therefore they are outside the scope of the register.

The government also proposed to not bring into scope trusts where:

- Their purpose and structure mean payments to beneficiaries are predetermined and highly controlled

- They are already supervised by HMRC or other regulatory bodies

- Statutory trusts, such as the Tenants’ Service Charge Contributions Protection Trusts

- Joint ownership trusts that exist solely for the purpose of jointly owning a home with a partner, relation or friend

- Trusts where two or more people co-own an asset such as a bank account, or shareholding, where the trust is legally and beneficially for themselves with concurrent and not successive interests

- Bare trusts

- Maintenance-fund trusts for historic buildings

- Approved value share option and profit-sharing schemes

- Vulnerable beneficiary trusts

- Personal injury trusts

- Trusts that consist solely of life insurance, income protection or payment of death benefit policy where payment is not made until the death or terminal illness of the insured

- Registered pension schemes that are already subject to regulation by the FCA or Pensions Regulator

- Charitable trusts

- Where a trust is already registered in an EU member state

Deadlines

- Trusts that are already in existence on 10 March 2020 (in line with the Directive) must register by 10 March 2022

- Trusts that are set up after 10 March 2020 must register within 30 days or by 10 March 2022, whichever is later

- Trusts that are set up on or after 10 March 2022 will have 30 days to register

- Once registered on the updated system, trustees will have 30 days from when they are aware of any changes to update the details

Penalties

There are two administrative offences set out in the Directive that relate to TRS – the failure to register on time and the failure to keep the record up to date and correct.

For the offence of failing to register on time, there will be no financial penalty, but a nudge letter will be sent to the trustee outlining their responsibilities.

For the offence of failure to keep the record up to date and correct, for a first-time offence, there is no financial penalty, but a nudge letter will be sent. Subsequent offences could result in a penalty of £100 for each offence.

However, any trustee who deliberately fails to register on time or deliberately fails to keep the record up to date and correct may be subject to a financial penalty in the first instance.

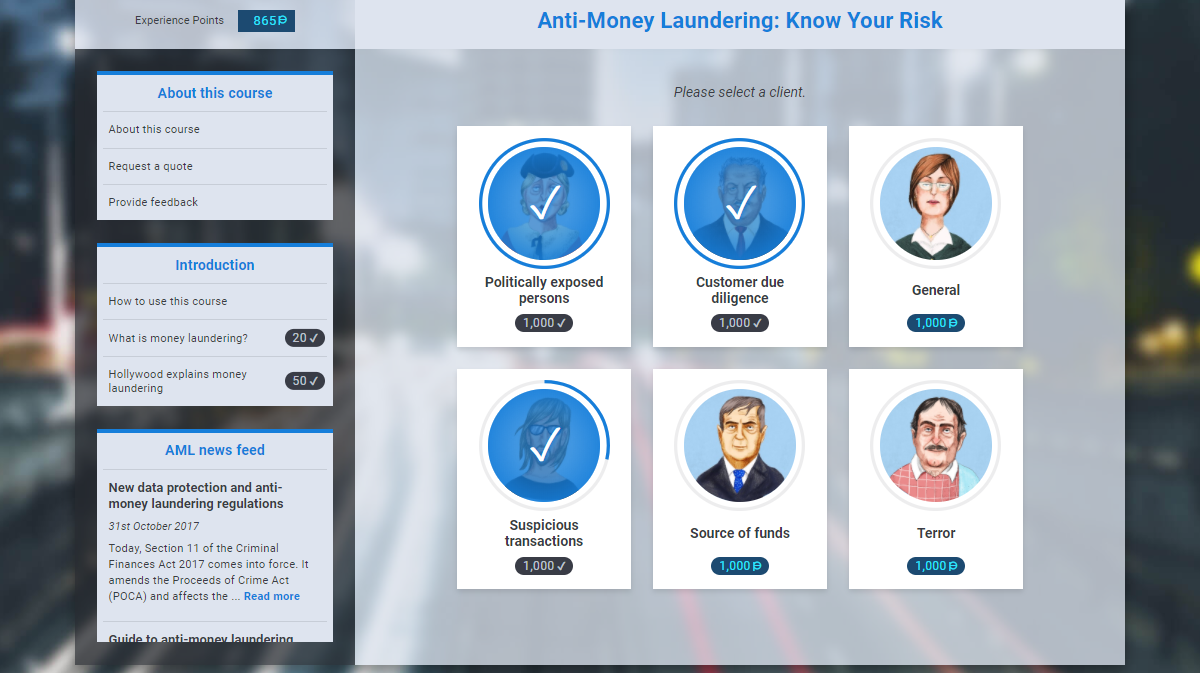

Updated anti-money laundering training

All VinciWorks’ anti-money laundering courses have been updated to ensure that they reflect the latest regulations across all relevant jurisdictions. If you are a VinciWorks client and currently license our AML training, your courses have automatically been updated.