What are the implications for firms that fall short?

You conducted your customer due diligence (CDD) when you onboarded your client. It’s all part of your effort to stay compliant with Know Your Customer (KYC) and Anti Money Laundering (AML) regulations.

But the regulations are constantly changing, your client’s circumstances are evolving and the implications for making a mistake are getting increasingly high. You need to keep track of the changing risks. You need to stay on top of compliance requirements to avoid exposure to financial crime and penalties.

It is no longer sufficient to do your due diligence at onboarding and in periodic intervals.

Firms need to perform ongoing monitoring for AML to capture any developments, update customer profiles and keep track of the changing risks.

What exactly is ongoing monitoring in AML?

Ongoing monitoring is the process of routinely refreshing and enriching client KYC data, reflecting current circumstances to ensure it is comprehensive and up to date for AML compliance purposes.

Ongoing monitoring will usually involve checking:

Ultimate Beneficial Ownership (UBO)

To maintain compliance, firms need to investigate ownership changes to identify those who would pose a greater risk to the business so they can take appropriate action. Firms that miss changes open themselves up to unknown risk exposure.

Sanctions

These lists are constantly changing with people and entities being added and removed, so regularly checking them is important for managing risk. Also, some countries may not feature on any sanctioned/watchlist and yet are at high risk for exposure to money laundering (ML) and terrorism financing (TF). These countries require an ongoing compliance programme to prevent your business from being involved in financial crime.

Politically Exposed Person (PEP)

A client with whom you do regular business could suddenly become a PEP thanks to a new appointment in a global company or by winning an election. Once a PEP is identified, they need to be flagged and reviewed and could be subject to enhanced due diligence (EDD).

Adverse media

Monitoring the public profile of clients is critical to identify changes in their risk profile and protect the business from reputational damage. This could lead to a review of risk assessments and the compliance approach.

The benefits of an automated system

An ongoing monitoring programme is like a guard standing watch, making sure your business stays safe. But it can be a laborious process to manage if you are working with a manual system. Firms that automate this process can simply periodically examine changes in items like PEP status, UBO, sanctions and adverse media. The systems quickly screen against dynamic up-to-date global databases for monitoring any changes in client risks and exposure.

You can be informed of updated client info on a daily or weekly or quarterly basis and potential risks that could affect the financial health and reputation of your firm can be quickly identified.

And you can sleep well at night.

How can VinciWorks’ AML client onboarding solution help?

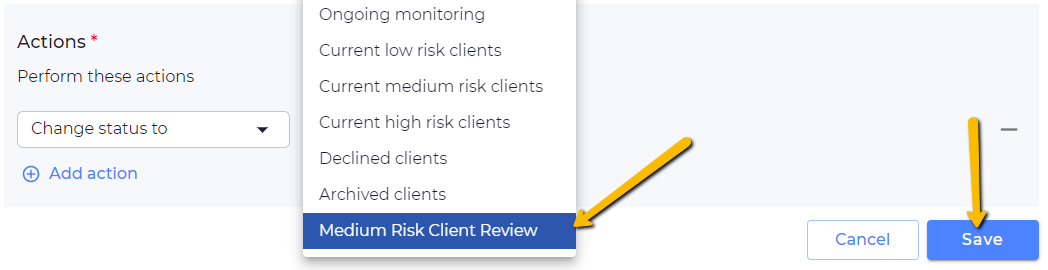

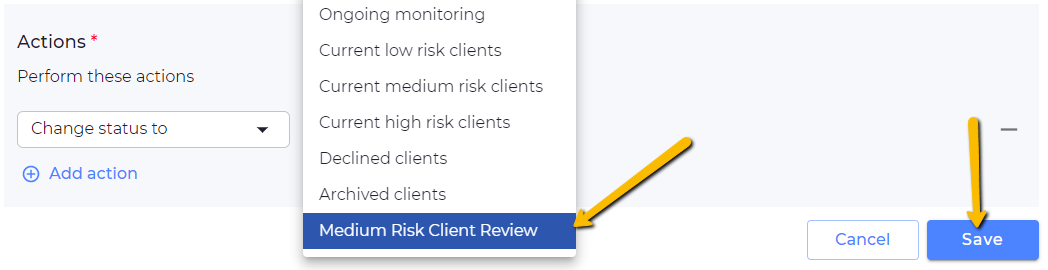

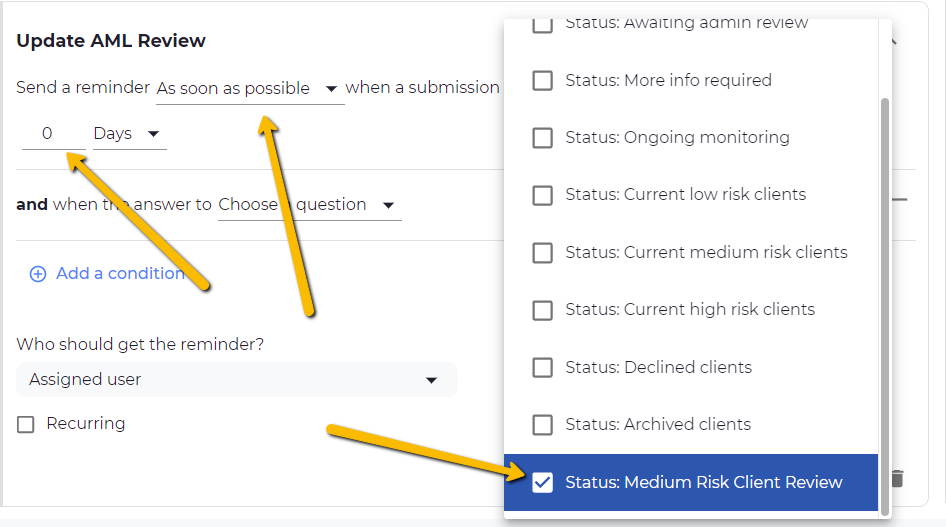

Our AML solution comes with time-based automation, allowing admins to fully automate the ongoing monitoring process and the ability to set a client or matter file to ‘re-open’ after a period of time, depending on the risk level assigned to the client or matter, ensures that no client or matter is left without periodic review.

Download our guide to AML ongoing monitoring

We have created a comprehensive guide to ongoing monitoring, including some tips for law firms. Stay on top of all the latest regulations and make sure your firm doesn’t fall short.