Canada’s updated mandatory disclosure legislation under Bill C-47 has just received Royal Assent and therefore has now become law. One of the key areas addressed by Bill C-47 revolves around the extensive revisions made to the Canadian mandatory disclosure rules.

What is the background?

In the 2021 Canadian Budget, it was announced that Canada would be amending the Income Tax Act to require certain transactions to be reported to the Canadian Revenue Agency (CRA). These new Mandatory Disclosure Rules are set to be implemented in 2023.

In February 2022 the Canadian Department of Finance released draft legislation which included a description of mandatory disclosure measures which will ultimately help the CRA to become aware of tax evasion and aggressive tax avoidance much earlier on in a transaction.

A revised version of the draft legislation was released in August 2022 and included a lower threshold for informing the CRA about relevant “notifiable” transactions and “uncertain tax treatments”.

On 22 June 2023, this revised version under Bill C-47 became law.

Which type of transactions requires reporting?

The Canadian Department of Finance has issued a list of transactions and a series of transactions requiring disclosure by taxpayers, advisers, promoters, and certain other persons. These include the following, however, they are likely to be expanded in the future:

- Manipulating CCPC status to avoid anti-deferral rules applicable to investment income – Intended to ensure that individual taxpayers cannot gain a tax advantage by earning investment income through a corporation they control.

- Straddle loss creation transactions using a partnership – This is intended to stop taxpayers who are engaging in financial arrangements that seek to reduce tax by generating artificial losses with the use of complex financial instruments or derivatives.

- Avoidance of deemed disposal of trust property – Intended to stop taxpayers are engaging in transactions that seek to avoid or defer the 21-year deemed realisation rule

- Manipulation of bankruptcy status to reduce a forgiven amount in respect of a commercial obligation – Intended to stop taxpayers who are entering into arrangements in which they are temporarily assigned into bankruptcy prior to settling or extinguishing a commercial obligation in order to reduce a forgiven amount in respect of a commercial obligation to nil.

- Reliance on purpose tests in section 256.1 to avoid a deemed acquisition of control – Intended to identify situations where taxpayers rely on one of the purpose tests that does not apply to transactions or events that would otherwise have satisfied all of the other conditions enumerated within those provisions.

- Back-to-back arrangements – Intended to ensure that the thin capitalization rules cannot be circumvented through the use of certain back-to-back lending arrangements involving intermediaries.

In response to concerns of overreach expressed by several advocacy groups, the C-47 version of the rules includes carve-outs to narrow the scope of reportable transactions.

When do the updated laws apply?

All relevant transactions that closed on and after June 22, are required to be reported.

What is the reporting timeline?

The reporting deadline has been extended to up to 90 days from the day a deal closes (this is an increase from the original 45 days).

Who needs to report?

The reporting obligation falls on every advisor or promoter involved in a reportable transaction or series of transactions to make their own separate disclosure to the Canada Revenue Agency.

The act also created a new category of “notifiable transactions,” requiring reporting by advisors and promoters involved in transactions identical or substantially similar to ones the CRA has previously identified as potentially abusive. The Canadian tax authorities have yet to approve and make public the list of “notifiable transactions.

What are the penalties for noncompliance?

Penalties for non-compliance with the mandatory disclosure rules could be up to $110,000 plus the value of all fees charged.

How can VinciWorks help?

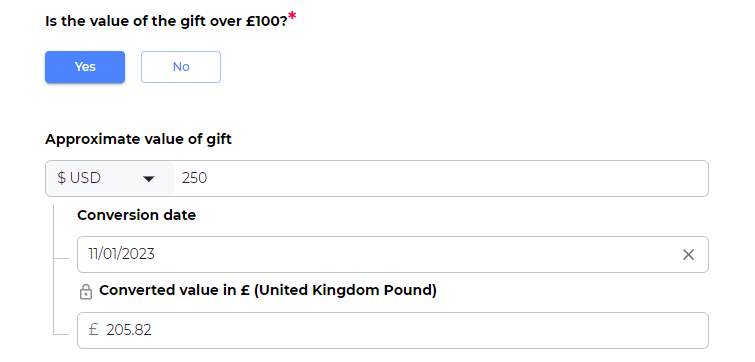

VinciWorks’ MDR reporting portal – Customisable workflows for all jurisdictions

VinciWorks’ Omnitrack is currently being used by many of our clients as an MDR reporting tool.

Core features:

- Built for international firms with different workflows and reporting jurisdiction

- Reminders for reporting deadlines and reviewing ongoing transactions

- Customisable dashboard to make it easier for administrators to stay on top of deadlines

- Customisable workflow to easily collect all pertinent data

- Choose from a number of hosting options, including cloud hosting and on-premises hosting