Canada is updating its mandatory disclosure legislation to be more in line with the OECD’s initiative to combat tax evasion, known as BEPS Action 12, which shows that the lack of timely, comprehensive and relevant information on aggressive tax planning strategies is one of the main challenges faced by tax authorities worldwide. The changes are set to go into force in 2023.

What is the background of Canada’s MDR?

In the 2021 Canadian Budget, it was announced that Canada would be amending the Income Tax Act to require certain transactions to be reported to the Canadian Revenue Agency (CRA). These new Mandatory Disclosure Rules are set to be implemented in 2023.

In February 2022 the Canadian Department of Finance released draft legislation that included a description of mandatory disclosure measures which will ultimately help the CRA to become aware of tax evasion and aggressive tax avoidance much earlier on in a transaction.

A revised version of the draft legislation was released in August 2022 and includes a lower threshold for informing the CRA about relevant “notifiable” transactions and “uncertain tax treatments”, and stipulated that the new rules will begin in 2023.

Which type of transactions requires MDR reporting?

The draft legislation stipulates that when any one of the following hallmarks is present, it will mean that a transaction is considered to involve an “avoidance transaction”:

- Contingent fee arrangements – when a promoter or advisor is entitled to certain contingent fees with respect to the transaction;

- Confidentiality protections – a promoter or advisor obtains “confidential protection” with respect to the transaction; and

- Contractual protections – the taxpayer or certain other persons obtain “contractual protection” with respect to the transaction. (There is an exclusion when dealing with “normal” contractual protection such as when a transaction is “offered to a broad class of persons,”).

Is there a “main benefit” test?

Under the updated legislation, a transaction will be considered reportable if one of the main benefits of entering the transaction is to obtain a “tax benefit”. This is a significantly lower threshold than the current legislation which requires reports only when there is an “avoidance transaction”.

What are “notifiable transactions” under Canadian MDR?

Notifiable transactions include:

- Transactions that the CRA has found to be abusive; and

- Transactions identified as transactions of interest (i.e., where more information is required to determine if a transaction is abusive).

The description of a notifiable transaction would set out the fact patterns or outcomes that constitute the transaction in sufficient detail to enable taxpayers to comply with the disclosure rule.

What are examples of “notifiable transactions” under Canadian MDR?

Sample descriptions of notifiable transactions include:

- Manipulating Canadian-controlled private corporation status to avoid anti-deferral rules that apply to investment income, such as:

- “Skinny” voting shares – issuing shares for nominal amounts

- Issuing options to a non-Canadian resident person to acquire majority voting shares in a company

- Incorporating a company in Canada but running it under the laws of a foreign jurisdiction

- Creating loss straddle transactions using a partnership

- Avoiding the 21-year deemed disposition of trust property, such as:

- Indirect transfer of trust property to a different trust or a non-resident

- Transferring a trust using dividends

- Manipulating bankruptcy status to reduce a forgiven amount relating to a commercial obligation; such as:

- Through “temporary” bankruptcy before settling debts to allow it to be subsequently annulled.

- Relying on certain purpose tests to avoid a deemed acquisition of control

- Using back-to-back arrangements to circumvent the thin income tax capitalization rules

Who is required to report?

Either the taxpayer who is entering the “notifiable” transaction or another person entering the transaction on behalf of the taxpayer will have to make a report. This would apply to all advisors or promoters of a transaction who receive a contingent fee based on a tax benefit or a fee in connection with contractual protection. These are categorised into three different types of reporters:

- Taxpayers

- Advisors

- Promotors

The updated draft legislation stipulates that reporting obligations generally will not apply to those who only provide clerical or secretarial services with respect to the transaction. It also excludes banks, insurance companies and credit unions that do not know that the transaction is a “notifiable” transaction.

How many reports are required under Canadian MDR?

Each person who is required to report needs to send the CRA a separate report. A single report on behalf of all persons who are involved in the transaction will not be acceptable.

There will be some exceptions to this rule such as in a partnership when a report by one partner will be sufficient on behalf of the whole partnership, or when one employee reports on behalf of a whole firm. However, when multiple firms are advising on a transaction, multiple reports will be expected.

What is the format of the report?

The report will include:

- Information about the expected tax benefits

- Details of contractual protection

- Details of contingent fees

- Details of the transaction

- Details of the provisions that are being utilised, such as which Income Tax Act provision is being relied on

- A list of additional people who are required to report

- Other transactional information.

When does the report need to be filed?

There is a 45-day deadline for reporting, and the triggering event is the earliest of:

- The date the taxpayer becomes contractually obligated to enter the transaction; or

- The day the taxpayer enters into the transaction

Does legal professional privilege apply?

There will be an exception for information that is subject to attorney-client privilege.

What are the penalties for non-compliance with Canadian MDR?

Taxpayer penalties are:

- $500 per week for each failure to report a reportable transaction or a notifiable transaction, up to the greater of $25,000 and 25% of the tax benefit; or

- For corporations that have assets with a total carrying value of $50 million or more, $2,000 per week, up to the greater of $100,000 and 25 per cent of the tax benefit

Promoter penalties are:

- 100% of the fees charged by that person to a person for whom a tax benefit results;

- $10,000; and

- $1,000 for each day during which the failure to report continues, up to a maximum of $100,000.

When is the effective date of the new legislation?

Canadian MDR will come into effect in 2023. However, the penalty provisions will require royal assent before they can come into force.

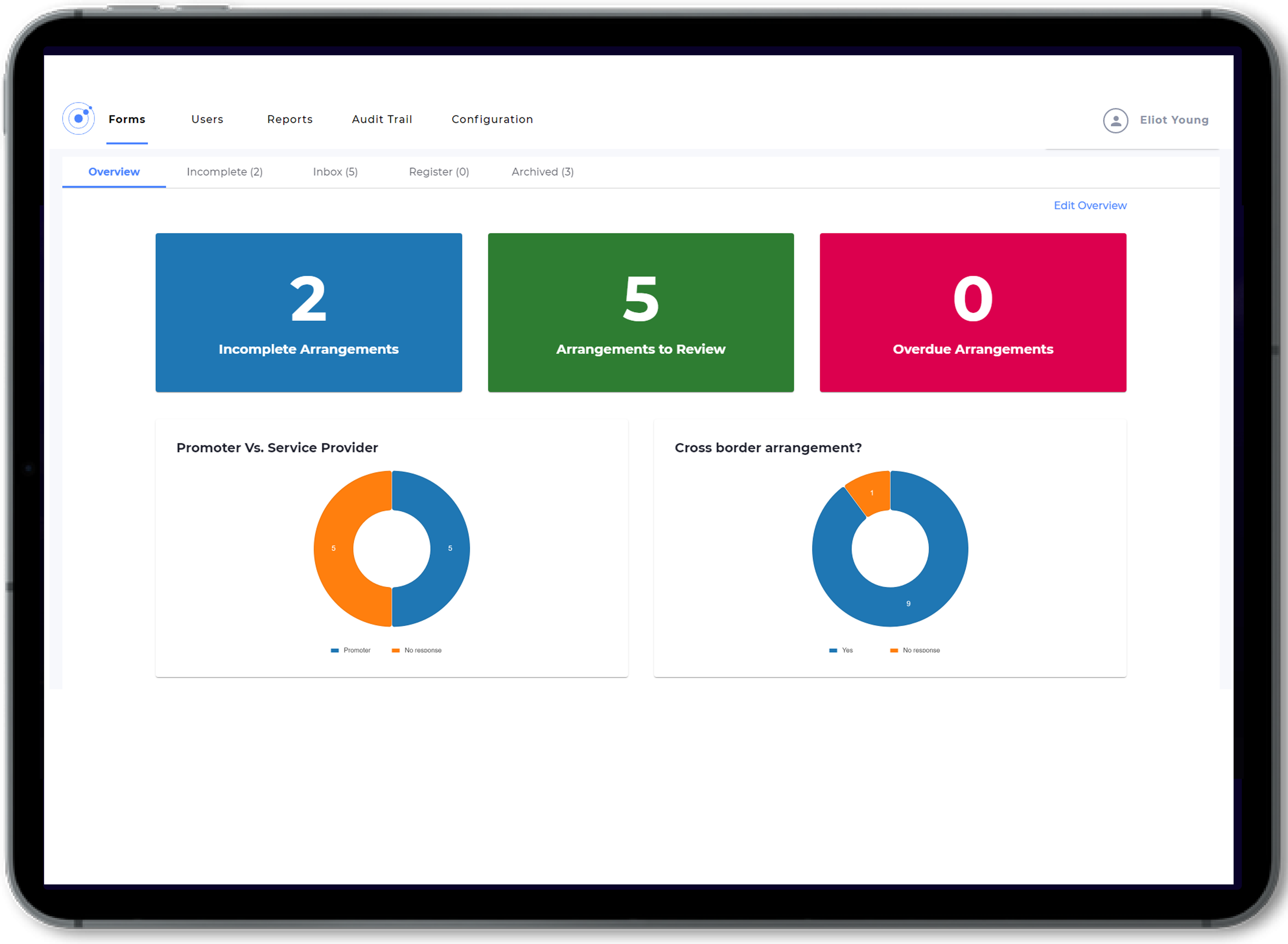

VinciWorks’ MDR reporting portal – Customisable workflows for all jurisdictions

VinciWorks’ Omnitrack is currently being used by many of our clients as an MDR reporting tool.

Core features

- Built for international firms with different workflows and reporting jurisdiction

- Reminders for reporting deadlines and reviewing ongoing transactions

- Customisable dashboard to make it easier for administrators to stay on top of deadlines

- Customisable workflow to easily collect all pertinent data

- Choose from a number of hosting options, including cloud hosting and on-premises hosting

To book a demo, or to learn more, simply complete the short form below and someone will get in touch.