Market abuse refers to processes in which individuals and/or firms aim to decrease market integrity and reduce investor protections. An

What is market manipulation?

Market manipulation occurs when individuals act in ways that prevent the market from operating in a free and open manner. This can involve providing false information about the supply, demand

Why would someone engage in market manipulation?

People usually engage in market manipulation to generate an increase of securities or to potentially undermine a competitor.

Methods in which individuals or firms engage in Market Manipulation

Individuals and Firms engage in a

Media channels: Market abusers use the media to advertise an investment without revealing a conflict of interest.

Ownership: Market abusers use a series of transactions to conceal the ownership of investments.

Pump and dump: Market abusers disseminate positive, false information to drive up share prices. They then sell the shares once the price has peaked.

Trash and can: Market abusers disseminate negative information to drive down share prices.

Wash trade: The same investment is bought and sold repeatedly to give the impression of increased demand.

While it appears like there are so many opportunities for such unlawful

How to deal with Market Manipulation?

In order to prevent these instances from occurring, safe

Market Sounding

Market sounding is a legitimate communication of information, prior to the announcement of a transaction, in order to gauge the interest of potential investors in a possible transaction and the conditions relating to it.

Stabilisation

This is the purchase or offer of securities undertaken by an investment firm in the context of a significant distribution of securities exclusively for supporting the market price of those securities for a predetermined period of time, due to selling pressures in such securities.

Legitimate behaviours

These are

Along with these safe harbours, regulatory bodies exist to prevent the onset of market manipulation.

In July 2016, the Market Abuse Regulation (MAR), which contains prohibitions on market manipulation, took effect across Europe. In the UK the Financial Conduct Authority (FCA) exists as a regulator for financial firms and financial markets. The FCA detects whether firms violate the MAR and punishes them accordingly. They also deal with suspicious transactions and order reporting regime.

Investment Recommendations

An investment recommendation refers to information that suggests an investment strategy concerning one or several financial instruments or the issuers, including any opinion as to the present or future value of the price of these instruments, intended for distribution channels or for the public. In order for investment recommendations to be credible, they must meet transparency requirements. This prevents the dissemination of false or misleading information and enables investors to trust the validity of the recommendations given. Further, it is imperative for investment recommendations to be as objective as possible to ensure that any potential biases are

Examples of Market Manipulation

Montgomery Street Research

In an attempt to raise the firm’s funds, in 2014 Montgomery Street Research engaged in wash trading, which involves the simultaneous purchase and selling of securities to give off the impression that there is

J.P. Morgan Chase/HSBC

Morgan Chase and HSBC manipulated the prices of silver futures and

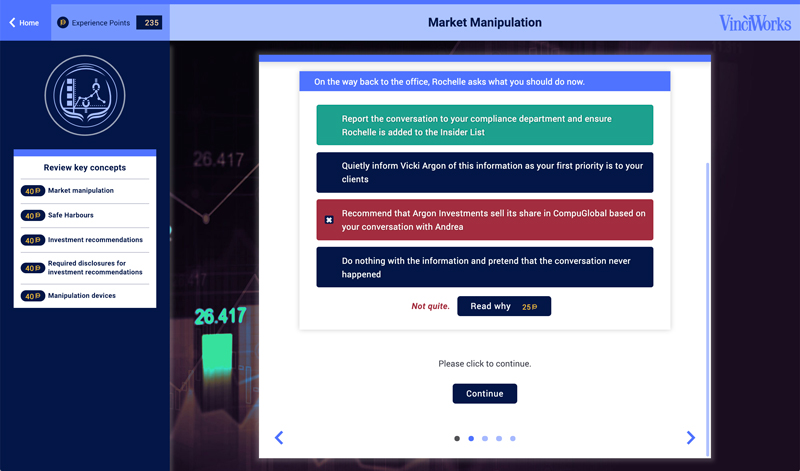

Module on market manipulation included in VinciWorks’ Market Abuse Course

VinciWorks course, Market Abuse: Know Your Trade, contains a module on Market Manipulation. The interactive course presents scenarios that