Register for our DAC6 email updates

Intermediaries located across Europe breathed a great sigh of relief last month when most EU member states announced they will be postponing their reporting deadlines for DAC6 by 6 months due to COVID-19. This means that DAC6 reporting will be pushed off until 2021.

However, some member states, including Germany, have decided not to adopt the optional deferral and to continue with the original DAC6 timeline. If you are an intermediary that has a legal presence in Germany and were planning on waiting until 2021 to report your historical arrangements in a different EU Member State, think again.

How will Germany’s decision affect intermediaries?

VinciWorks has been in regular contact with member state tax authorities. The German Federal Ministry of Finance (Bzst) has made it very clear that if you or your firm have a German legal presence and have been involved in a reportable DAC6 arrangement since June 2018, then you are required to make any DAC6 reports in Germany without delay.

While under DAC6 there is an exemption of an intermediary from its domestic reporting obligation, this is only in limited cases, such as if a report for the specific cross-border arrangement has already been submitted by an intermediary in another member state. Seeing as less than a handful of member states have opened up their reporting portal, it is unlikely that a German entity will be able to rely on a different intermediary to report.

If your firm has a non-German EU office and a German office that have both been working on a DAC6 reportable arrangement, and each of these offices are considered separate intermediaries for DAC6 purposes, then you should not wait until 2021 to report the arrangement. The German office must make a DAC6 report (and provide the non-German EU office with the Arrangement Reference Number and disclosure ID).

What is the DAC6 German reporting deadline?

The deadline to report historical arrangements, triggered between 25 June 2018 and 30 June 2020, is due by 31 August 2020. For arrangements from 1 July 2020, reports are expected within 30 days from a triggering event.

It is important to note that under German law, the reporting obligation may shift from a non-German intermediary to a relevant taxpayer person in Germany if there are no German-based intermediaries in an arrangement.

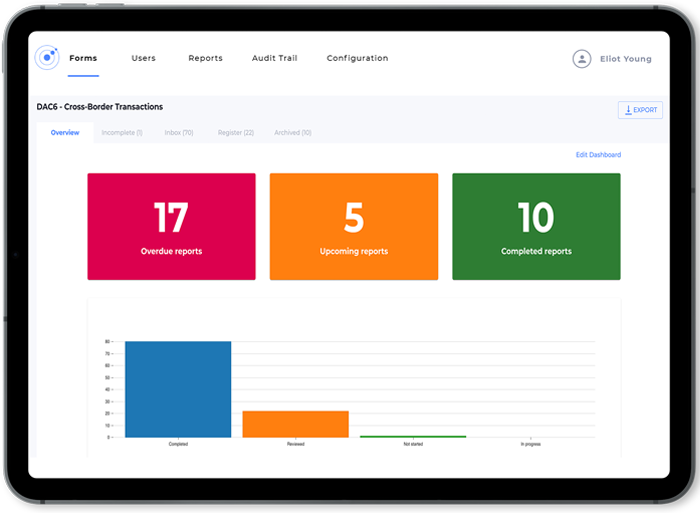

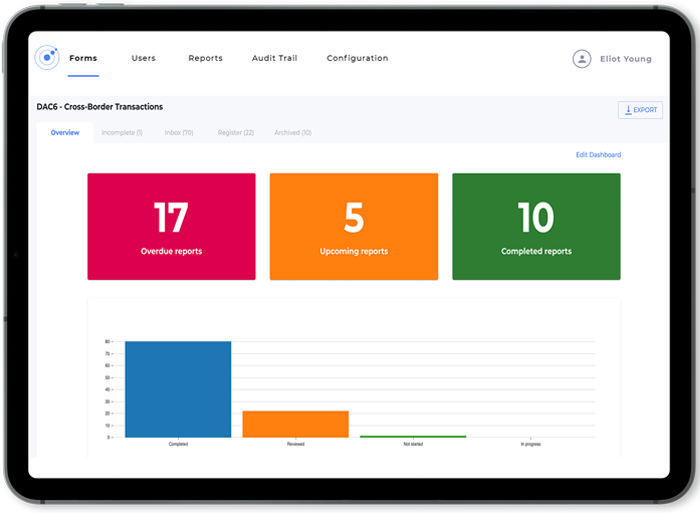

VinciWorks’ DAC6 reporting portal for intermediaries

Our DAC6 reporting tool provides firms with the expertise, knowledge and technical infrastructure to comply with the EU Directive in every EU jurisdiction. The tool uses a built-in knowledge engine to guide users through the DAC6 process and recommends which transactions should be reported. It features workflows designed and updated for the intricacies of each EU member state’s implementation of DAC6. Countries with stricter reporting guidelines are flagged.