What is the history of the EU’s list of non-cooperative jurisdictions?

In January 2016, the EU Commission presented its Anti-Tax Avoidance Package, in which it committed to a “clear, coherent and objective” approach to tackle tax governance in relation to non-EU jurisdictions.

In November 2016, the Council mandated the Code of Conduct group (business taxation), a Council working party, to carry out the preparatory work to establish a list of non-cooperative jurisdictions.

The Code of Conduct group screened 92 jurisdictions, selected on the basis of:

- their economic ties with the EU

- their institutional stability

- the importance of the country’s financial sector

In December 2017 the EU launched its initial list of non-cooperative jurisdictions for tax purposes. The list included non-EU countries that encourage abusive tax practices, which erode member states’ corporate tax revenues.

The EU list of non-cooperative jurisdictions for tax purposes is a tool to tackle:

- tax fraud or evasion: illegal non-payment or underpayment of tax

- tax avoidance: use of legal means to minimise tax liability

- money laundering: concealment of origins of illegally obtained money

The first list included 17 non-EU countries or territories. A state of play document was also released that set out the jurisdictions which had responded with sufficient commitments. They needed to take effective action by the end of 2018, or in some cases 2019, to avoid being listed in the future.

How often is the list updated?

The EU list is regularly updated and revised as part of a dynamic monitoring of the measures implemented by jurisdictions to comply with their commitments.The most current lists of non-cooperative jurisdictions was released in October 2021, with the next update expected in February 2022.

Do EU Member States have any additional requirements?

EU member states are required to put in place efficient defensive measures in non-tax and tax areas. Defensive measures help to protect their tax revenues, and fight against tax fraud, evasion and abuse. The EU council took the view that these measures should be both “effective and proportionate”.

EU Member States also agreed in December 2017 to apply at least one of the following administrative measures:

- reinforced monitoring of transactions

- increased risk audits for taxpayers who benefit from listed regimes

- increased risk audits for taxpayers who use tax schemes involving listed regimes

On 5 December 2019, the Council endorsed guidance for further coordination. EU Member states also committed to use the EU list in the application of at least one of four specific legislative measures as of 1 January 2021 (or July 1, 2021 should they face institutional or constitutional issues):

- non-deductibility of costs incurred in a listed jurisdiction

- controlled foreign company (CFC) rules, to limit artificial deferral of tax to offshore, low-taxed entities

- withholding tax measures (WHT), to tackle improper exemptions or refunds

- limitation of the participation exemption on shareholder dividends

Which EU Member States already have defensive measures in place?

The Code of Conduct Group (Business Taxation) has undertaken a review of defensive measures applied by Member States and the related findings were published in November 2021.

According to the synthetic overview included in the publication, most EU Member States had implemented at least one defensive tax measure in place against countries on the EU List:

| Country | Administration Measures in place | Legislation in place (by 1 January 2022) | Nondeductibility of costs | Controlled ForeignCompany rules | Limitation of participationexemption | Withholding tax measures |

| Austria | ✅ | ✅ | ✅ | |||

| Belgium | ✅ | ✅ | ✅ | ✅ | ✅ | |

| Bulgaria | ✅ | ✅ | ✅ | ✅ | ✅ | |

| Croatia | ✅ | ✅ | ✅ | ✅ | ||

| Cyprus | ✅ | ✅ | ||||

| Czech Republic | ✅ | ✅ | ✅ | |||

| Denmark | ✅ | ✅ | ✅ | ✅ | ||

| Estonia | ✅ | ✅ | ✅ | ✅ | ✅ | |

| Finland | ✅ | ✅ | ✅ | |||

| France | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Germany | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Greece | ✅ | ✅ | ✅ | ✅ | ||

| Hungary | ✅ | ✅ | ||||

| Iceland | ||||||

| Ireland | ✅ | ✅ | ✅ | |||

| Italy | ||||||

| Latvia | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Lithuania | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Luxembourg | ✅ | ✅ | ✅ | |||

| Malta | ✅ | ✅ | ✅ | |||

| Netherlands | ✅ | ✅ | ✅ | ✅ | ||

| Poland | ✅ | ✅ | ✅ | |||

| Portugal | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Romania | ✅ | ✅ | ✅ | |||

| Slovakia | ✅ | ✅ | ✅ | ✅ | ✅ | |

| Slovenia | ✅ | ✅ | ✅ | ✅ | ||

| Spain | ✅ | ✅ | ✅ | ✅ | ✅ | |

| UK |

What’s next?

It is important to stay up to date with updates to the amendments to the EU’s list of non-cooperative jurisdictions. You can find all the revisions and other important milestones here.

How VinciWorks can help?

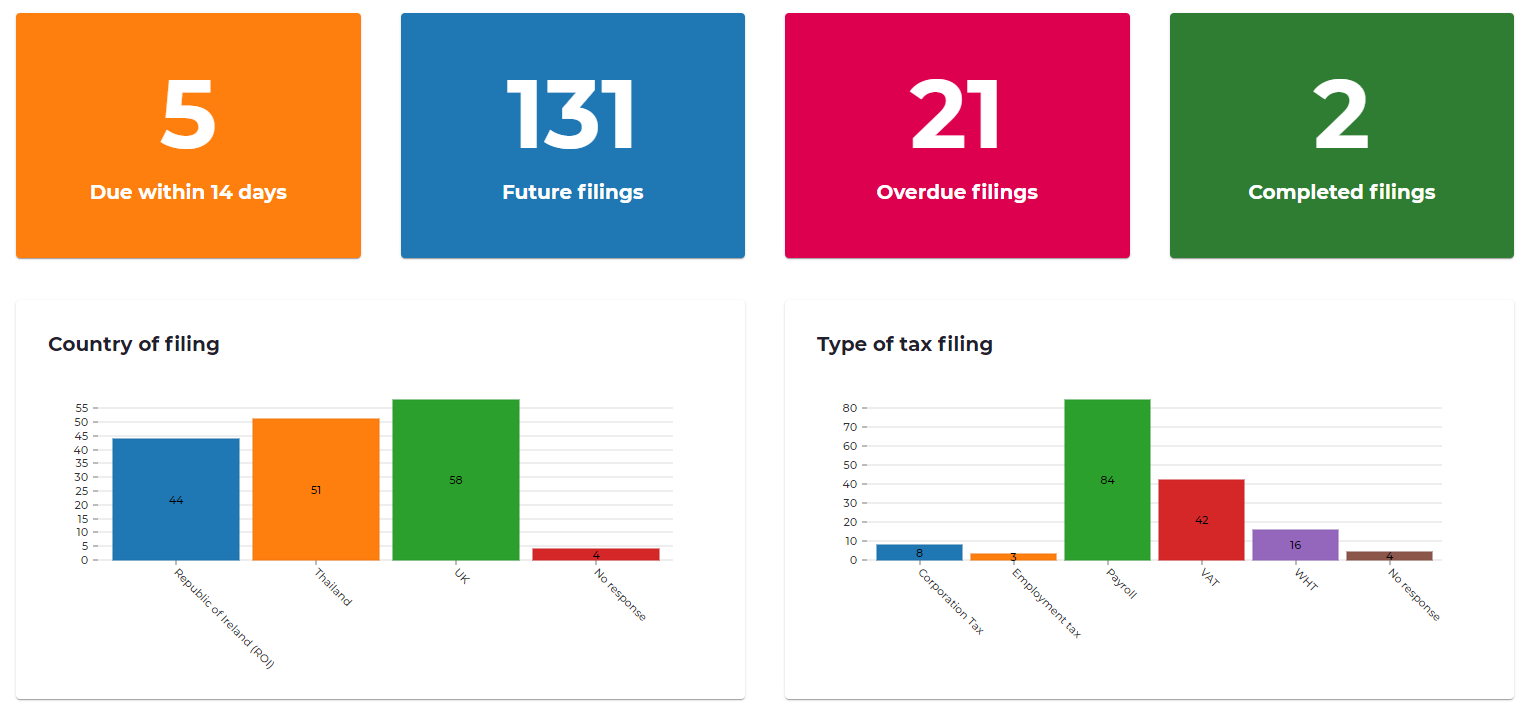

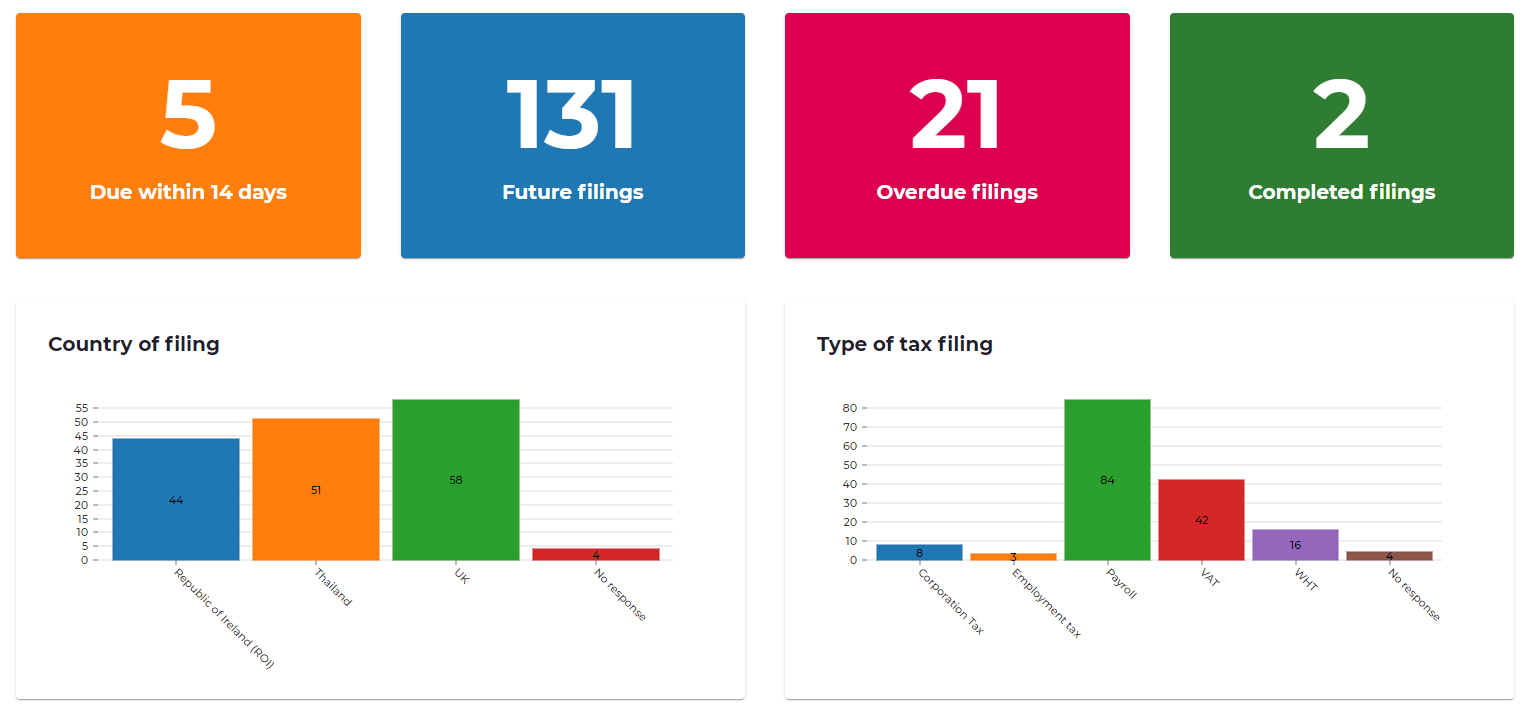

Tax departments in all organisations need to keep to strict deadlines for tax obligations such as corporation tax, payroll and VAT payments. This often gets even more challenging when dealing with multiple jurisdictions.

Omnitrack, VinciWorks’ data collection tool, allows you to record, manage and complete all tax filing requirements. From setting filing deadlines, choosing a warning notice period and recording the obligation fulfilment, Omnitrack has you covered. Get in touch with us to see how Omnitrack can help your business.