File Reviews – Best practice guidance

What are File Reviews? File reviews are a core compliance process for many law firms. They are undertaken periodically, as a way of detecting any compliance deficiencies within a client file. Whilst the precise questions involved will vary from firm to firm, a File Review will usually consider: General compliance issues, such as whether a […]

DAC6 Netherlands: Supervision process

The Dutch MDR team has put a lot of time and energy into open communication throughout the DAC6 process. Whether with intermediaries, software builders or others, the Dutch MDR team has always been available for consultation. The MDR team were aware early on of the potential number of intermediaries and made the decision to update […]

DAC6 Cyprus: Reporting deadline extended, yet again

The Ministry of Finance at the Cypriot Tax Department have announced they will be extending the deadline for reporting DAC6 arrangements to 30th November 2021. This extension will apply to all retroactive reporting dating back to 25 June 2018. The deadline has been extended for all the following cases: Reportable cross-border arrangements that have been […]

ISQM 1 : What is required of firms?

Now that the ISQM 1 Standard has been approved, accounting firms need to begin deciding what they need to do to comply with the new quality management standards. While they only go into force in December 2022, preparation will require input from multiple departments and firms are already thinking about the systems they need to […]

DAC6 UK: Consultation update

In light of the Brexit Fair Trade Agreement that passed through parliament on 30 December 2020, HMRC announced that there would be major changes in the UK’s approach to DAC6. HMRC confirmed in its shocking New Year’s Eve announcement email that in 2021, the UK government would repeal the legislation implementing DAC6 in the UK […]

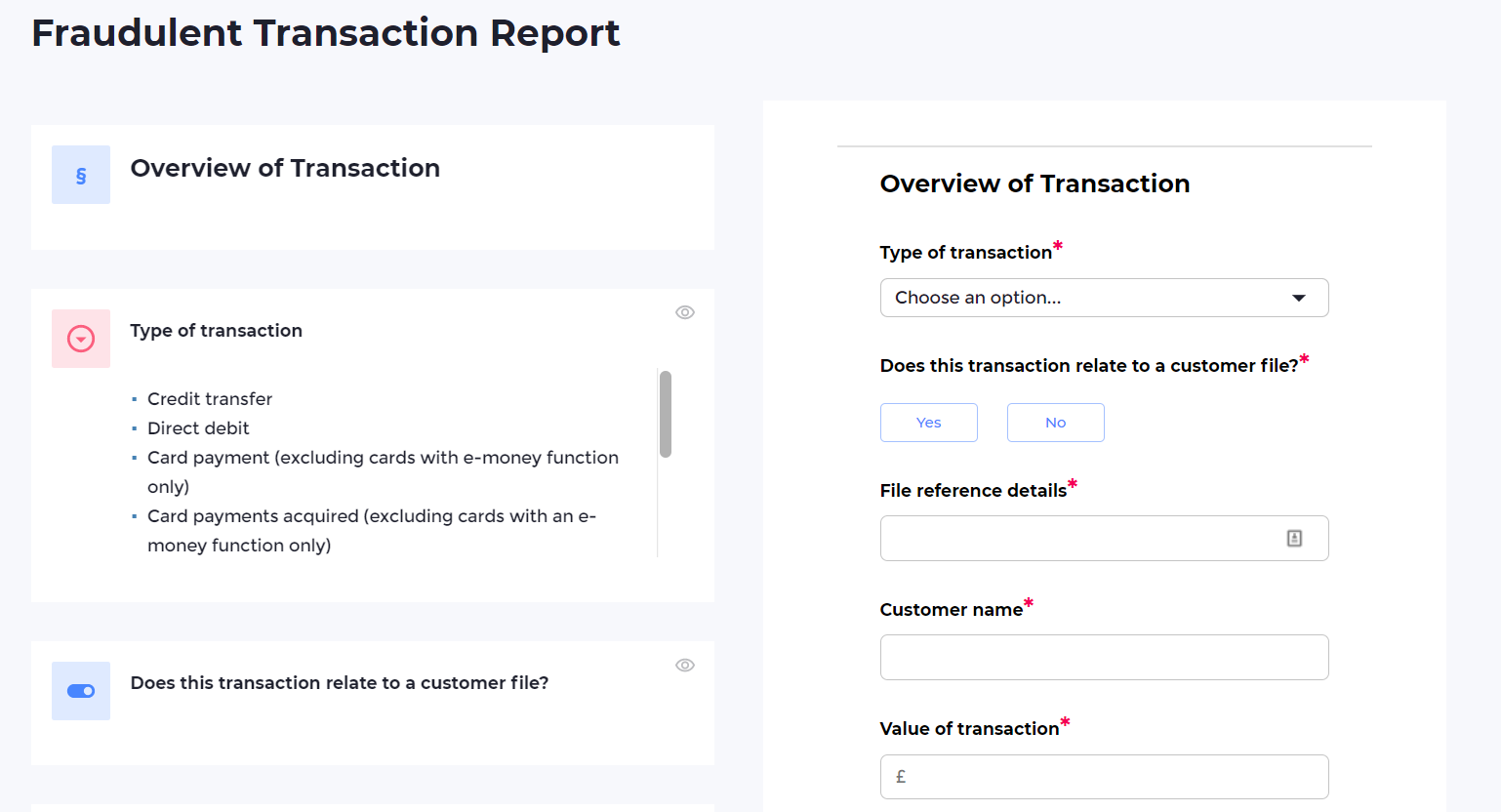

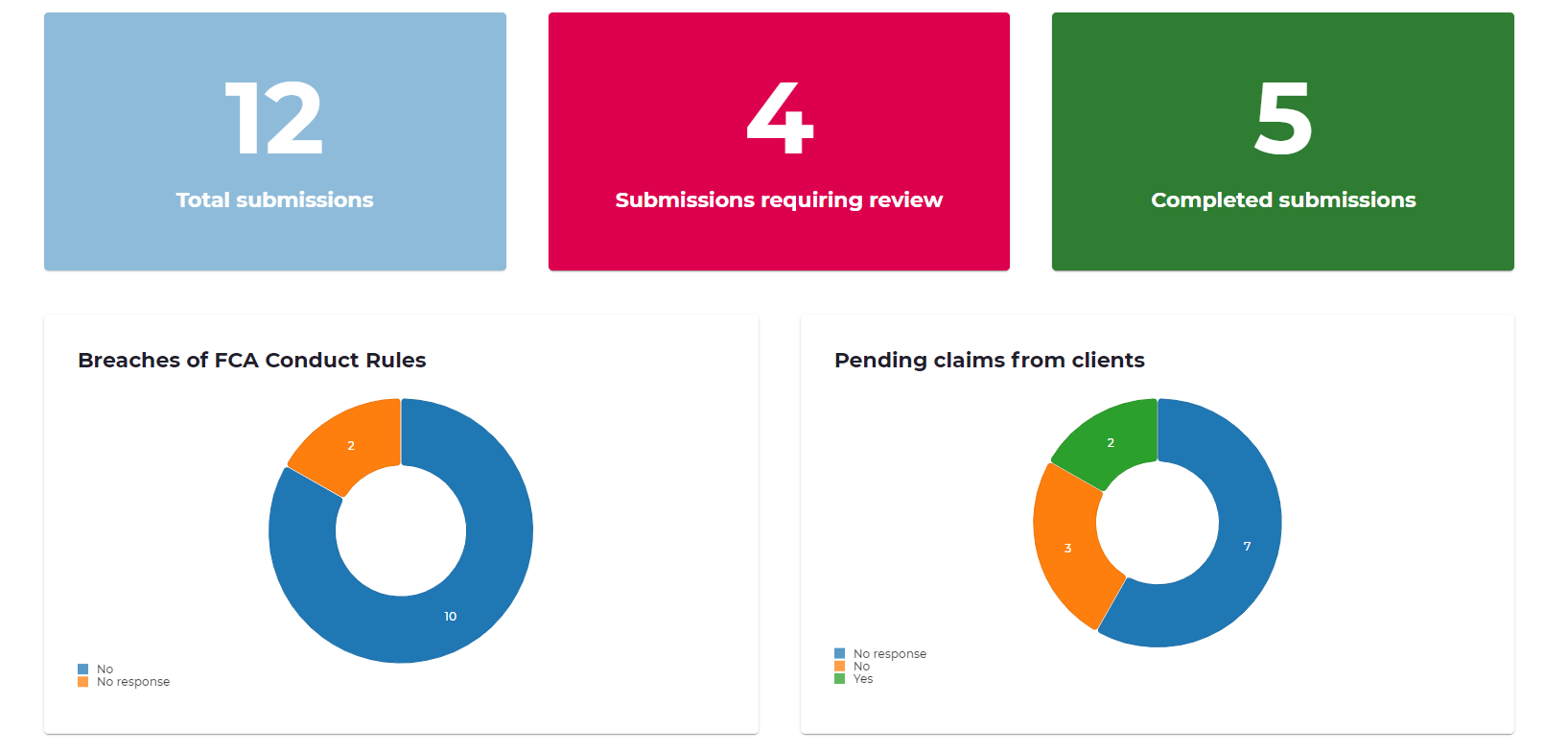

Understanding FCA fraudulent transaction reports

The Payment Services Regulations 2017 (the ‘Regulations’) apply to banks, building societies, card issuers, and other firms which provide payment services. These are the services set out in the Regulations and summarised on the FCA’s website, and include payment initiation services, account information services and services which allow cash to be paid into (or withdrawn […]

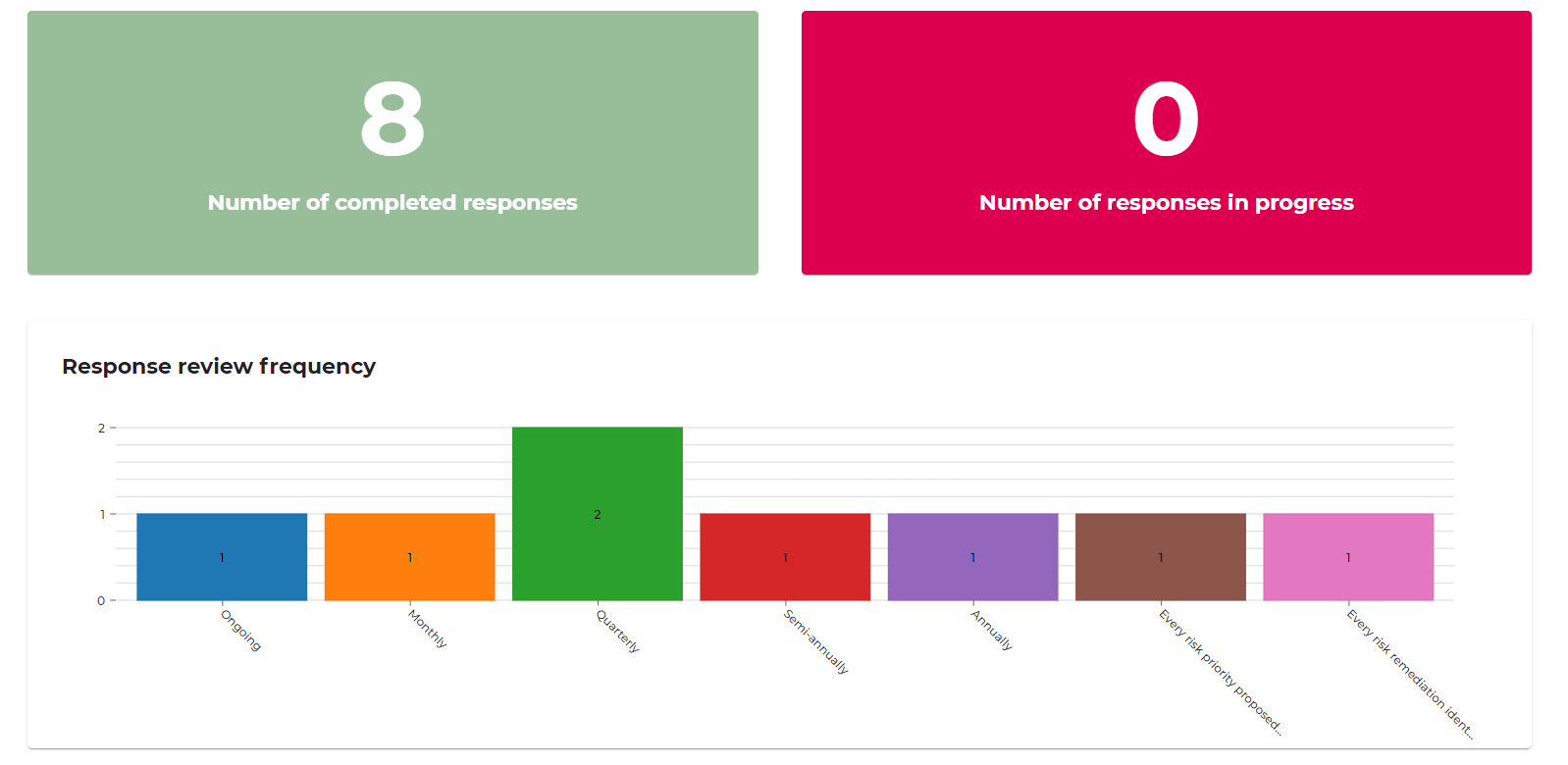

Annual declaration tracking best practice – download our guide

The complications of declarations Many organisations collect data from employees for compliance and regulatory purposes on a regular basis, but current processes and tools have major shortcomings. With current processes, it’s hard to track who has and hasn’t filled out forms, challenging to keep track of forms, especially in large firms, and regarding annual forms […]

What is Compliance Training?

Workplace compliance is more than just following the office rules. In fact, used in a business context, it usually refers to requirements, conditions or restrictions imposed and enforced by various external regulatory bodies, e.g., public organisations or government agencies. Examples of regulatory bodies in the UK include the Financial Conduct Authority (FCA), Information Commissioner’s Office […]

Professional Indemnity Insurance (PII) for FCA firms – What you need to know

What is Professional Liability Insurance (PII)? Professional liability insurance, also known as errors and omissions (E&O) insurance, is a type of coverage that protects professionals and organisations from liability claims arising from their professional services or advice. It provides financial protection for legal defence costs, settlements, or judgments if a client alleges that the professional’s […]