Keeping money launderers out of legal services has long been a priority of the SRA. In 2021, the SRA visited an average of 7 law firms a month to check on their money laundering systems. The majority were told to make changes to the way they work. Further, in its latest threat assessment, the National Crime Agency (NCA) estimated that at least 70,000 people are engaged in serious organised crime in the UK, with upwards of £12bn in criminal cash generated annually.

In this webinar, Compliance Office Founder and Director Andy Donovan, and VinciWorks Head of Legal and Product Research Ruth Mittelmann Cohen discussed the SRA’s findings and how firms can maintain AML compliance.

The webinar covered:

- How to prepare for an SRA AML audit

- A review of the SRA AML findings

- How to get your whole firm compliant with AML

- Unpacking firms’/ clients matter risk assessment

- Tools and resources for AML compliance

- Answering attendee questions

VinciWorks’ AML compliance suite

VinciWorks strives to make its AML compliance more than simply a tick-box exercise. Our AML courses are packed with realistic scenarios, real-life case studies and every customisation option you can think of. We have everything from in-depth induction training to refresher courses and five-minute knowledge checks.

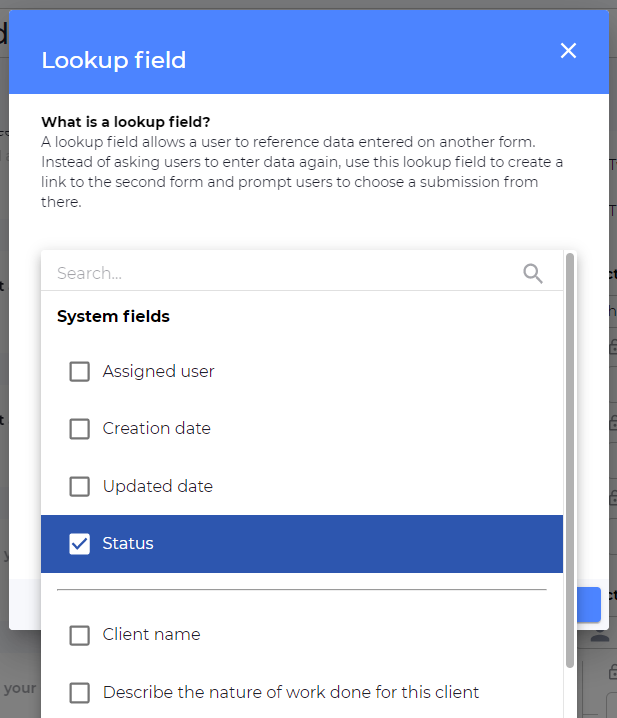

Further, law firms, accountancy firms and financial corporations are required to conduct risk assessments, client due diligence (CDD) and ongoing monitoring of their clients. The precise processes for CDD and risk assessments are often complex and vary greatly, depending on industry and jurisdiction. Organisations using static forms to onboard clients can often struggle to implement systems which adequately incorporate all the interconnected requirements of these two vital AML components.

Omnitrack’s AML onboarding solution enhances both the risk assessment and document collection aspects of client onboarding. Our template workflows adapt to the specific risks posed by each client, based on factors such as jurisdiction, type of entity and industry.

Independent anti-money laundering audits with Compliance Office

Compliance Office has the expertise needed to help you conduct an independent AML audit. Their team keeps their pulse on the latest AML requirements and your audit will often be administered by former SRA staff.

SRA compliance health checks

With years of expertise in SRA conduct, money laundering and accounts rules, as well as access to a comprehensive suite of templates and training solutions, Compliance Office’s SRA consultants can assess weaknesses and solve problems with speed and efficiency.