We have recently launched a new risk-focused course based on new EU and UK AML laws.

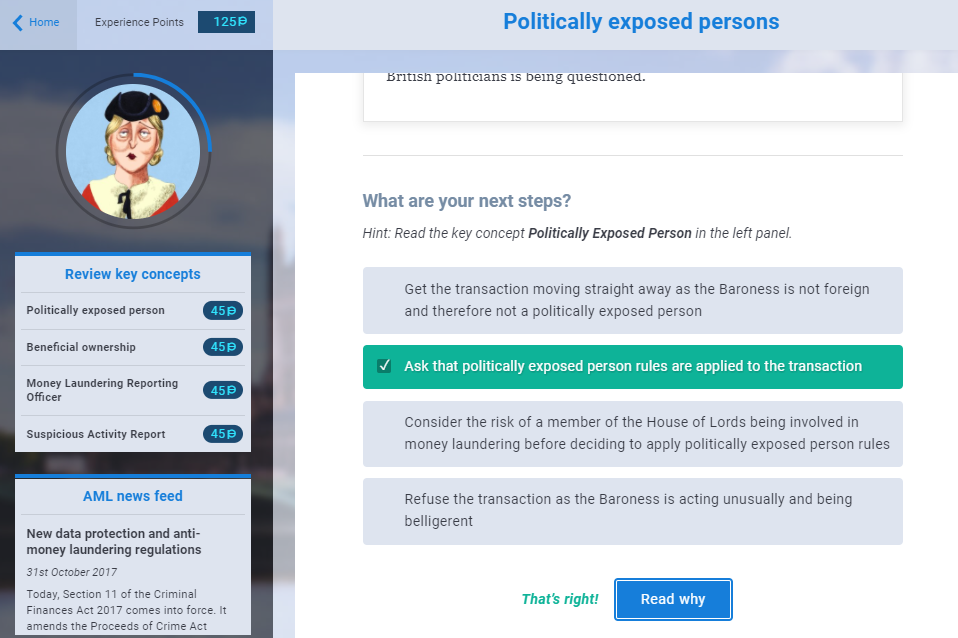

Anti-Money Laundering: Know Your Risk drops users into a realistic, immersive scenario-based simulation to test their knowledge, understanding and ability to uncover the risks of money laundering hidden in everyday transactions. The Fourth EU Money Laundering Directive and the UK’s Money Laundering Regulations 2017, passed this year, mandates a fully risk based approach to AML. This means the white list has gone, as have exemptions from client due diligence procedures.

As a long-standing leader in the field of e-learning, Anti-Money Laundering: Know Your Risk asks users to assess the inherent risks and red flags of over 100 available scenarios and give each situation a risk score. Uniquely in e-learning, users receive live feedback and can compare their risk tolerance against others in their firm, industry and globally.

Gain experience points as you take the course

The new course enables users to accrue experience points as they work through various AML scenarios. Veteran users will gather experience points more quickly, updating their knowledge and completing the course in as little as fifteen minutes. Whereas newer users or those that need a more in-depth refresh are encouraged to spend more time reading additional content and building up a bank of points to demonstrate their AML knowledge.

Course features

- Over 100 real life scenarios

- Interactive tools to spot suspicious clients and dodgy transactions

- Tailored for your industry and AML procedures of every jurisdiction you operate in

- Fully based on the Fourth Directive covering all areas of AML

- Accrue experience points throughout the course and evaluate scores in a customisable leaderboard

- Expert users are able to “test-out”, allowing them to complete the course in less time

- Compare your risk assessments with other professionals in your industry

- Add your own custom scenario questions

- Translated versions available in multiple languages

New AML course available in eight versions

The course is available in multiple versions for various industries with specially designed scenarios for each. This includes:

- Accountancy

- Estate Agency

- Financial Services

- Private client law

- Commercial law

- Offshore law

- Non-regulated business law

Overviews of money laundering legislation for any country or jurisdiction in the world can also be uploaded to the course for review by the user.

New publication: the story behind AML: Know Your Risk

How did VinciWorks come to create an interactive, risk-based course? We have published a whitepaper explaining how new regulations have inspired us to change our approach to online training. You can download the whitepaper here.