VinciWorks has just released a new version of its tax evasion course specifically geared to the corporate sector. While the first version of Tax Evasion: Failure to Prevent is tailored for businesses in the regulated sector, the new version has been modified to better accommodate scenarios that often face companies in non-regulated industries.

Key changes

More content relevant to diverse industries

VinciWorks corporate users are based in industries as diverse as hospitality, retail and manufacturing. The corporate version of the course provides content that is more directly relevant to the kinds of issues people face in non-regulated sector industries.

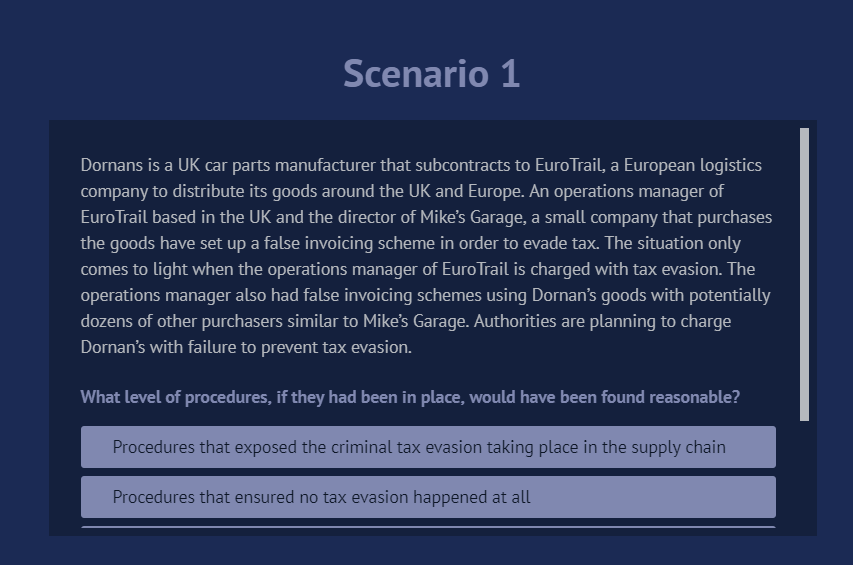

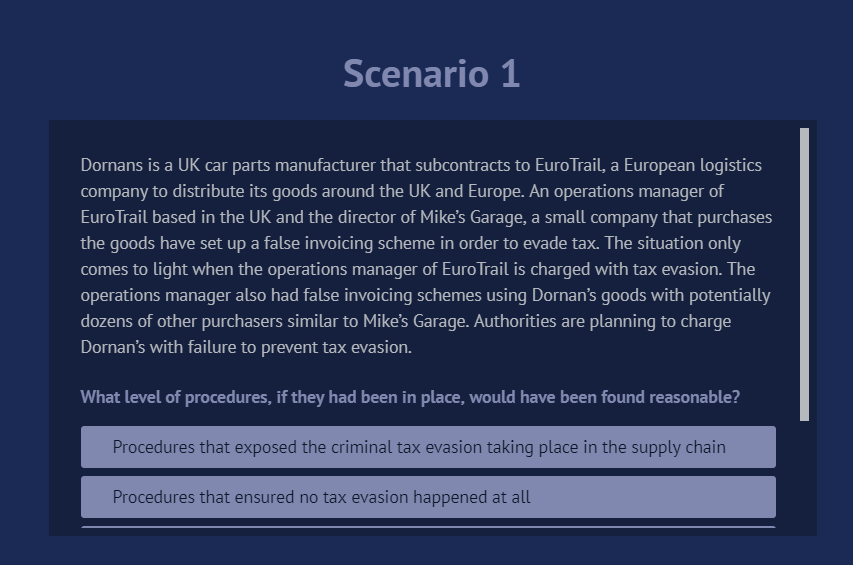

Chose from six corporate scenarios

There are now six specifically corporate scenarios to choose from, with up to three included in the course. Scenarios, like everything else in the course, is fully customisable. You can upload your own scenarios or VinciWorks can help you design learning scenarios that are relevant to your company and industry.

New test section

The text section in this version of the course addresses issues that can arise in business across a range of industries. For example, what would you do if your boss asked you to invest in a scheme to lower your tax liability? The text section gives users a chance to demonstrate that they understand the risks they can face and how to respond to them.

New criminal facilitation quiz

Can your staff spot criminal facilitation? Scenarios in this section cover whistleblowing, the misrepresentation of services and clients providing false documents.

Demo the course

There are two versions of our corporate tax evasion course, a 45 minute course for high risk staff and a 15 minute version for all other staff. You can view the difference between the two versions here. Click on the buttons below to demo the course.