Say goodbye to fragmented processes and manage all your filing obligations with Omnitrack

Omnitrack is a powerful yet flexible data collection and reporting tool. Its established use cases include an AML client onboarding workflow, a gift and hospitality register, and a GDPR compliance suite. VinciWorks has also recently launched the Omnitrack Filing Calendar, which means you can now use one system to track all filing obligations, send reminder notifications and upload documents evidencing compliance.

Before we take a closer look at the Omnitrack Filing Calendar and one of its template workflows, this blog will outline some of the key challenges compliance staff face when managing filing obligations.

What are the compliance challenges?

Compliance teams often manage a plethora of filing commitments. These can include general obligations that apply to all organisations such as filing tax returns, or industry-specific regulatory requirements. Regardless of the nature of the obligation, meeting deadlines poses a consistent challenge, with potentially serious consequences for failing to comply. This is compounded when companies do not have a centralised tool, which can lead to a number of challenges.

By way of example, reminders for deadlines are typically recorded in a calendar, and evidence of submitted filings is usually saved in a file management system. But, by using these two separate tools, it is inevitable that compliance staff will be duplicating data and wasting time. It is also possible for auditing requirements to be neglected, as filing obligations can often be forgotten as soon as they have been completed. Compliance staff can also face uncertainty surrounding the precise process or filing requirements, without a system that incorporates guidance notes.

However, the absence of a centralised system is particularly problematic for large, multinational companies, where different offices, or teams, deal with different filing obligations. As processes diverge, it can become difficult for management to access an overview of all filing obligations and their current status, or even to identify the people responsible for them.

How can Omnitrack help?

Whether you choose from one of our template workflows or build your own form, Omnitrack can ensure you don’t miss any reporting dates, and enable you to view upcoming deadlines, set reminders and store evidence of filings in one location.

In addition to the benefits of having a unified system, Omnitrack can also ensure staff adhere to best practice by allowing system admins to add guidance notes, either to the body of a workflow or by including links to more extensive explanations.

Omnitrack’s flexibility means staff can choose whether to create a single workflow for all filing obligations or separate forms, based on the subject matter or person responsible. Compliance teams can also choose whether to manually input details of each filing obligation or to populate workflows by uploading a spreadsheet to Omnitrack. Once the workflow has been finalised, staff are then guided through these three steps to compliance:

- Record all deadlines for the next quarter, year or beyond. Submissions automatically move from ‘in progress’ and are either assigned a status of ‘future filings’ or ‘overdue’, depending on the deadline date.

- Manage all filings, with compliance staff helped by reminder notifications until tasks are done, as well as being able to instantly spot all overdue submissions on the graphical dashboard

- Complete tasks by noting the filing date and uploading documents, after which submissions automatically move to an archive, with an automated audit trail of all submissions.

Example use case: tax filings

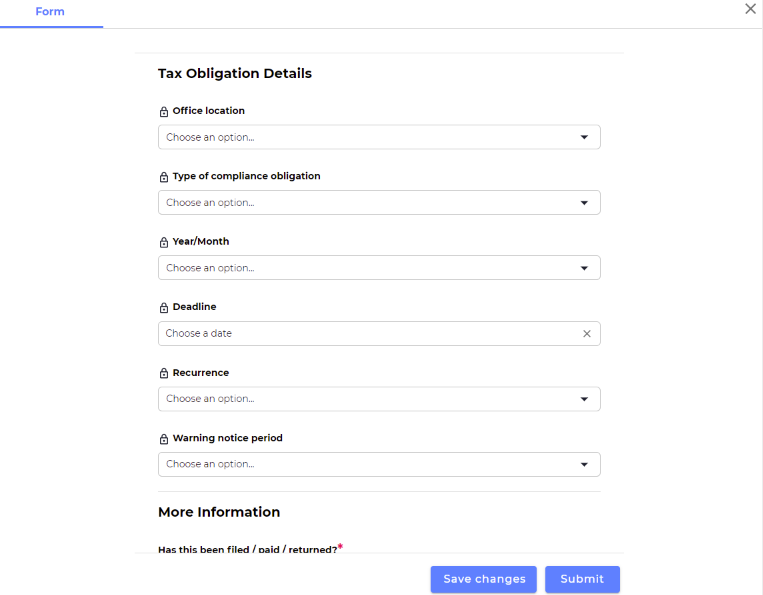

One of Omnitrack’s template workflows can be used to record all deadlines for corporation tax, payroll, VAT payments and more. Once one of these tax obligations is selected, users simply set the filing deadline and choose a warning notice period (e.g. two weeks before the deadline), which then generates a customised reminder direct from Omnitrack. Users then continue to use the Omnitrack system to confirm tasks have been completed, by uploading evidence of payments made or returns filed.

Omnitrack’s conditional logic also makes it the perfect tool for large organisations with a number of teams or offices, as the workflow can adapt based on the office, or team, selected, with users presented with different tax obligations depending on the jurisdiction or person responsible.

As with all Omnitrack use cases, the Omnitrack Filing Calendar can be customised to suit each organisation’s needs. Whether you wish to change the rules for automated reminders, amend a template workflow, or even build one from scratch, VinciWorks’ intuitive and sleek system can ensure you comply with all your filing obligations in 2022 and beyond.

Contact us now to book a demo

Complete the short form below to learn more and book a demo.