A brief guide to avoiding bribery

Gifts and donations are often a part of business, whether it is cultural norms or celebrating a completed negotiation. However, there are certain instances in which it is important to be vigilant of the circumstances behind donations as they may be attempts to bribe. here is a short guide to spotting potential red flags and avoiding bribery.

Charitable or political donations can be viewed as attempts of bribery if there is something unusual about the inherent qualities or timing of the donation. Bribery is not always a mutual arrangement and it may not be known to the donee if there is a bribe occurring. When receiving gifts and donations it is important to be vigilant as some types may be seen as improper.

One question you can ask yourself is, “will this gift be perceived as an attempt to improperly influence my behaviour?” If the answer is yes or if you are unsure, it is best to politely refuse the gift. Any attempt to curry favour with a business or individual through gifts, donations, travel, or accommodation is an act of bribery.

Learn more about VinciWorks’ gifts & hospitality solution here

Corporate gifting

What is corporate gifting?

Corporate gift giving is the act of giving gifts by a company or organisation to its employees, clients, customers, partners, suppliers, or other stakeholders as a way of expressing appreciation, building relationships, and promoting goodwill.

Corporate gifts can range from personalised items, such as pens or coffee mugs with the company logo, to high-end gifts such as electronics, gift certificates, or luxury vacations. They may be given as part of a marketing or promotional strategy, as a reward or recognition for employee performance, or as a gesture of thanks to clients or partners.

Corporate gift giving is often used as a way to strengthen business relationships, foster loyalty, and improve brand awareness. It can also be a way to show appreciation to employees, and to enhance the company’s reputation and public image. However, it is important to keep in mind ethical and legal considerations when giving corporate gifts, such as avoiding conflicts of interest, maintaining transparency, and adhering to relevant laws and regulations.

How does corporate gifting work?

Corporate gifting typically works by a company or organisation identifying specific individuals or groups to whom they wish to give gifts. This could include employees, clients, customers, partners, or suppliers, and the gifts may be given for a variety of reasons, such as to show appreciation, celebrate a milestone, or mark a holiday or special occasion.

Once the recipients have been identified, the company will typically select gifts based on their preferences, needs, or interests, as well as the company’s budget and branding objectives. This could involve working with vendors or suppliers to create customised gifts, such as personalised stationery or branded electronics, or selecting pre-made gifts from a catalogue or online retailer.

The gifts are then typically distributed to the recipients in a variety of ways, such as during a company event, through the mail, or delivered personally by a representative of the company. It’s important for companies to be transparent about the gift-giving process and avoid any appearance of impropriety or conflicts of interest.

What is a corporate gift-giving policy?

A corporate gifting policy is a set of guidelines or rules that a company or organisation creates to govern the practice of giving gifts to employees, clients, customers, partners, suppliers, or other stakeholders. The policy sets standards for the types of gifts that can be given, who can receive them, and under what circumstances.

The purpose of a corporate gifting policy is to ensure that the practice of giving gifts is ethical, transparent, and consistent with the company’s values and objectives.

What is included in the corporate gift-giving policy?

A typical corporate gifting policy should include the following:

- The purpose and scope of the policy, including who is covered by the policy.

- The types of gifts that are acceptable and those that are not allowed. This may include restrictions on the value or quantity of gifts, as well as rules on personalised or branded gifts.

- The process for selecting and approving gifts, including any review or oversight by management or compliance departments.

- Rules on the timing of gift-giving, such as restrictions on giving gifts during a bidding process or in connection with a specific transaction.

- Guidelines for maintaining transparency and avoiding conflicts of interest, such as requiring disclosure of gifts given or received.

Corporate gift policy limits

Corporate gift policy limits are the guidelines or rules that a company sets to regulate the giving and receiving of gifts within the organisation or with external parties, such as customers, vendors, and partners. These policies are designed to ensure that gifts are given and received ethically and appropriately, without creating conflicts of interest, compromising business relationships, or violating any legal or regulatory requirements.

Corporate gift policy limits may include limits on the type of gift one can give, such as prohibiting cash gifts or expensive luxury items, and value limits, to ensure the gifts are not too lavish or expensive. Companies may also restrict the occasions or circumstances under which gifts can be given or received. Additionally, companies may require employees to report any gifts they give or receive and to request approval before giving gifts above a certain value. Occasionally companies might allow exceptions to their gift policy limits in certain situations, such as for charitable donations or gifts to public officials when in compliance with local laws and regulations.

Corporate gift-giving laws

Corporate gift-giving is subject to various laws and regulations that aim to prevent corruption, bribery, and conflicts of interest. These laws vary from country and region and it is important for organisations to be aware of them in order to avoid any legal or ethical violations. Such laws may include anti-bribery laws, gift disclosure requirements, gift value limits, conflict of interest policies and tax implications.

Why are there gift-giving policies?

Gift-giving policies exist to prevent conflicts of interest and to ensure that gift-giving does not result in unethical or illegal behaviour. Companies may face legal and reputational risks if they violate gift-giving laws or engage in corrupt practices.

Are corporate gifts and donations considered bribery?

Corporate gifts and donations are not necessarily considered bribery if they are given or received in compliance with applicable laws and regulations and are intended to promote goodwill or establish a legitimate business relationship. However, if a gift or donation is given with the intent of influencing a business decision or gaining an unfair advantage, it can be considered bribery and is illegal.

It’s important for organisations to establish clear policies and guidelines for gift-giving and donation practices to ensure that they are ethical and compliant with applicable laws and regulations. In some cases, the line between legitimate gift-giving and bribery can be blurred, and companies need to be vigilant to avoid any perception of impropriety or unethical behaviour.

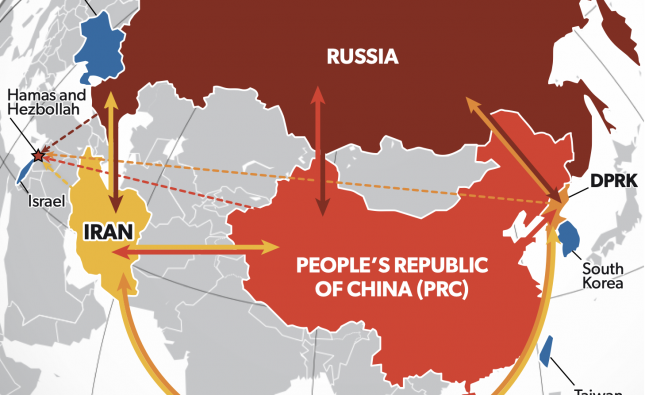

What is the FCPA?

The Foreign Corrupt Policies Act is an American legislation that outlaws any attempts of bribery of foreign officials. It applies to any US official, resident, or organisation who acts in any foreign practice. Additionally, it is applicable to any person who has a certain degree of connection to the United States whether they are present in the country or not

Prohibited conduct

A bribe does not need to be completed to become an illegal act. The promise of a payment for illegal purposes is sufficient and each violation can lead to prison sentences and heavy fines for both individuals and corporations. The following is a list of prohibited conduct from the Foreign Corrupt Policies Act.

- Payment, offers, authorisation, or a promise to pay money or anything of value

- For the purpose of (a) influencing any act or decision of that person, (b) inducing the person to do or omit any action in violation of their lawful duty, (c) securing an improper advantage, or (d) inducing the person to use their influence to affect an official act or decision

- In order to assist in obtaining or retaining business for or with, or directing any business to, any person

- Failure to prevent – organisations can be held vicariously liable for the conduct of their employees

Further anti-bribery guidance and resources

Information from this blog has been taken from VinciWorks’ course, Anti-Bribery: Know Your Deal. You can access further resources related to anti-bribery here.