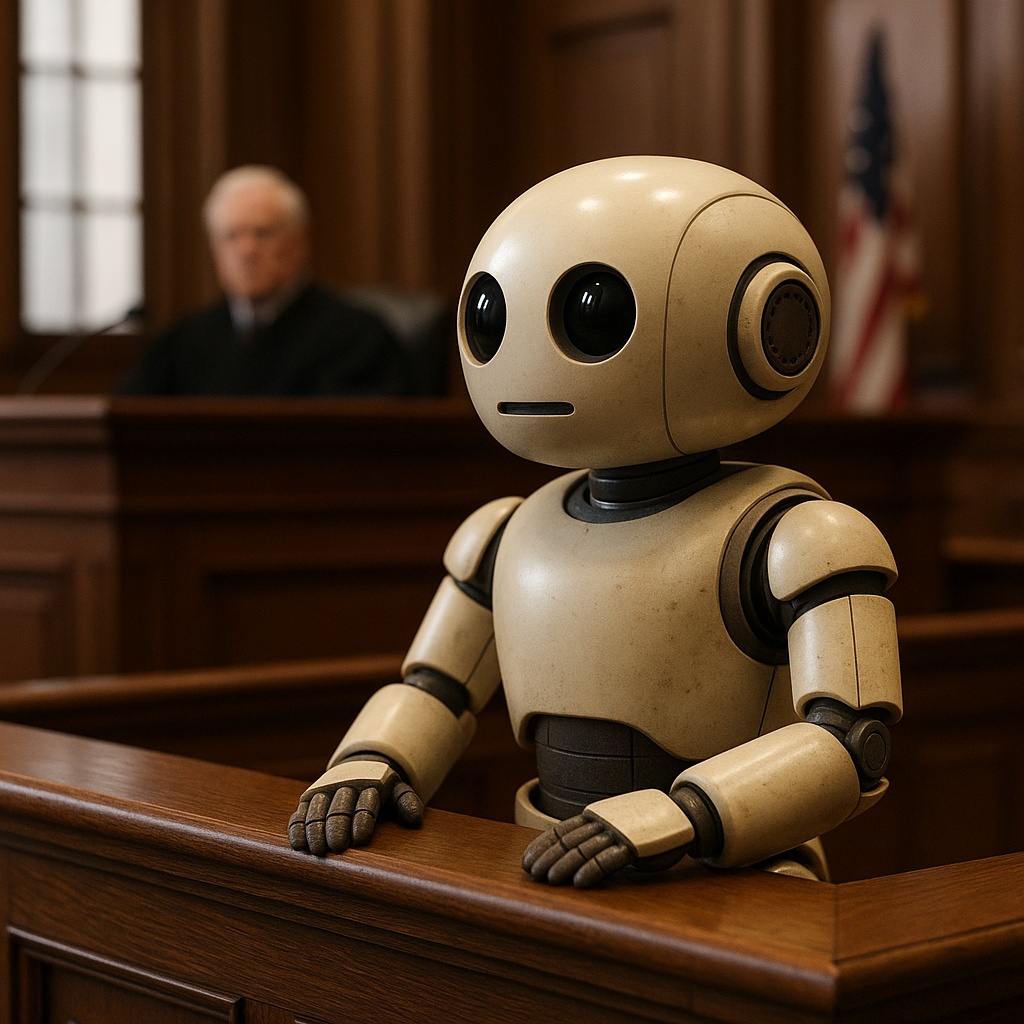

AI in the dock: Who is liable when machines get it wrong?

Artificial intelligence has become the quiet engine behind modern business. It writes copy, screens candidates, approves loans, forecasts demand and even decides which customer gets a discount. But what happens when it gets it wrong? Who should hold legal liability for AI systems? When AI systems misfire, for example a lying chatbot, a discriminatory […]

US Treasury announces significant change to SAR process

In one of the most consequential anti–money laundering (AML) developments in years, the US Department of the Treasury has announced sweeping clarifications to the rules surrounding Suspicious Activity Reports (SARs). Released on 9 October 2025 by the Financial Crimes Enforcement Network (FinCEN) in coordination with the Federal Reserve, FDIC, NCUA, and OCC, the new FAQs […]

When policies fail: The Colorcon sanctions case and what it means for compliance

In September 2025, the UK’s Office of Financial Sanctions Implementation (OFSI) imposed a £152,750 penalty on Colorcon Limited, a UK-based pharmaceutical coatings company, for breaching the Russia (Sanctions) (EU Exit) Regulations 2019. On the surface, the case might appear as a routine enforcement action involving payments through sanctioned Russian banks. But beneath the figures lies […]

Your 2026 digital compliance playbook: What are the key laws affecting cyber security and data protection?

The compliance landscape for cyber security and data protection in 2026 is a complex array of regulations. New and forthcoming laws across the UK and EU are transforming how cloud and digital service providers must manage data, security, and consumer rights. From the EU’s far-reaching Artificial Intelligence Act to the UK’s evolving data and online […]

Awaab’s Law: What property professionals need to know by 27 October 2025

Awaab’s Law, formally known as the Hazards in Social Housing (Prescribed Requirements) (England) Regulations 2025, will come into force on 27 October 2025. The law was introduced following the death of two-year-old Awaab Ishak, who died from a respiratory condition caused by mould exposure in his home. His death revealed serious gaps in how housing […]

VinciWorks Product Showcase — what’s new, what’s next

What’s the latest from the VinciWorks product offerings? Take a quick tour of what’s new and what’s next at VinciWorks. We’ve overhauled core courses (including AML), launched Conversational Learning v2, opened a resources hub inside the Portal, rebuilt Omnitrack reporting, and added two services that tie it all together: bespoke Learning Plans and fully custom […]

September compliance news round-up

What’s in this update? Fraud & AML: New failure to prevent fraud offence now in force; UK, EU, US and Australia all tightening financial crime rules. Data & Cyber: UK DUAA and EU Data Act reshape data regulation; surge in cyberattacks and AI-driven ransomware. Human Rights & ESG: Push for UK human rights due […]

Is big regulatory change afoot in the US? The future of AML supervision

At ACAMS Vegas this year, John K. Hurley, the Under Secretary for Terrorism and Financial Intelligence, signalled a serious rethink of America’s anti-money laundering playbook. His keynote wasn’t box-ticking rhetoric; it laid out an intelligence-first model, with law enforcement and national security agencies positioned as the true “customers” of the AML system. Hurley’s critique […]

What’s New in Astute LXP – September 2025 Update (v3.4.3)

This month’s release focuses on speeding up Previous LMS Records imports and resolving a range of issues across reporting, courses, emails, and surveys. Previous LMS Records Faster imports – Records from other LMS platforms now upload more quickly. Clearer feedback – Any learners not found in your organisation are highlighted during upload. No duplicate […]