Anti-money laundering for law firms

EU AML legislation requires law firms to conduct client due diligence before they are allowed to advise their clients. Firms are also required to keep such information up to date.

Some firms are still conducting client due diligence (CDD) via lengthy Word, PDF and Excel forms. Entries are then stored in spreadsheets, making it difficult to keep track of such reports, ensure correct courses of action are taken, update details and ensure any red flags are either resolved or escalated. Spreadsheets are limited by their two-dimensional nature, lack of automation tools and lack of security.

When a firm’s client changes circumstances, such as opening an office in a new country, firms need to be updated on this. Keeping clients’ details up to date via spreadsheet is challenging, with no easy way to track and resolve any red flags that may arise. Further, keeping such a spreadsheet up to date is a time-consuming task, with errors potentially proving costly.

AML requirements for law firms

AML requirements are crucial for law firms to ensure compliance with regulatory standards and mitigate the risk of facilitating illegal financial activities. These requirements include: Client Due Diligence (CDD), Risk Assessment, Knowing Your Customer, Suspicious Activity Reporting, Internal Controls and Training, Record Keeping, and Cooperating with Authorities.

Omnitrack’s AML solution

VinciWorks has evaluated the way businesses conduct client due diligence and KYC questionnaires and developed software that makes it easy to send out, update and manage the CDD process. The forms are fully customisable and include conditional logic so that clients are only asked questions related to their company, jurisdictions and industry. The graphical dashboard aggregates the data and delivers instant analysis.

The questionnaire comes ready-to-go with intelligent logic that allows the questionnaire to adapt as the client completes each question. For example, if the client operates in high-risk countries, the appropriate questions will appear. The tool streamlines the reporting process and cuts out tedious parts of the CDD process.

How does the AML risk assessment portal work?

Customise and publish form

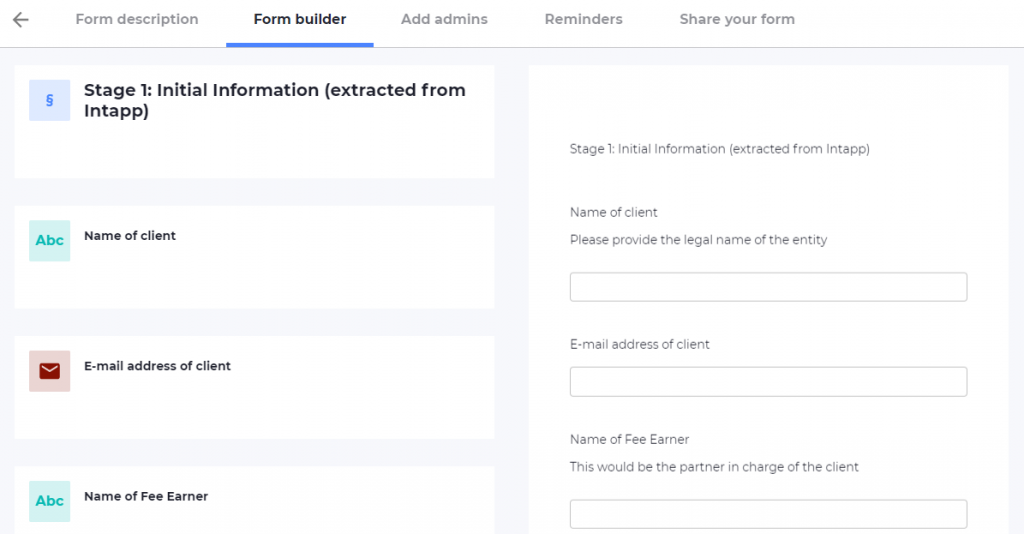

While our template is based on best-practice, each firm has their own requirements and preferences. Our forms are 100% customisable; for example, you may want to include guidance to explain certain terms or why answering a specific question is so important.

Send the form to the client and set up reminders

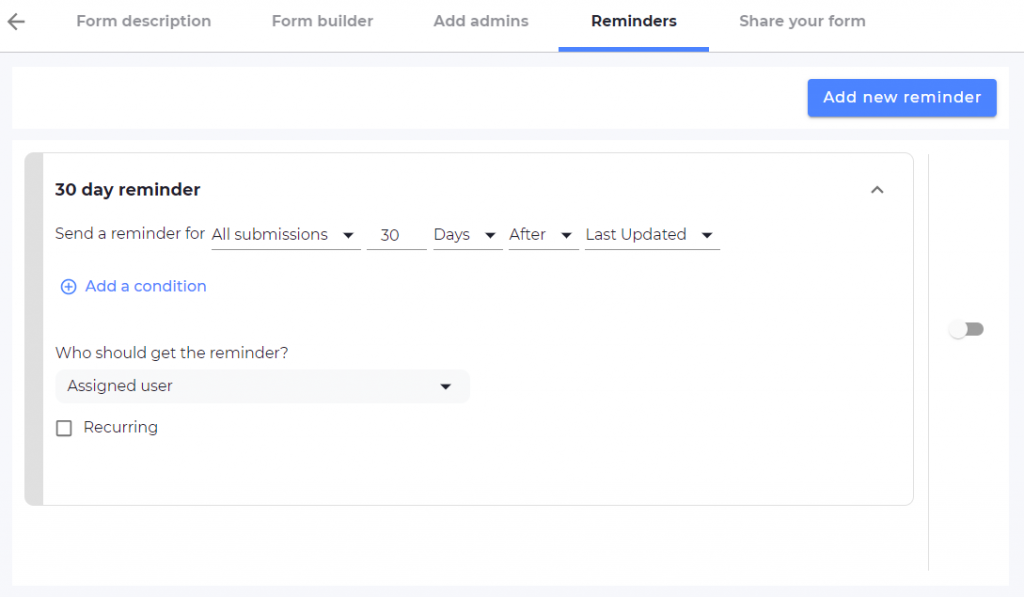

You can easily send the form by either providing them with a link to the form or sending it from Omnitrack. Automated email reminders can be set up to ensure the client completes the form in a timely manner.

Complete form

Send the client the form and ask them to complete it. In some cases, the firm will complete the form and send it to the client to sign. Administrators can then assess the level of risk the client has and whether any further CDD needs to be conducted. If further information is required, the form can then be sent back to the client.

Track responses

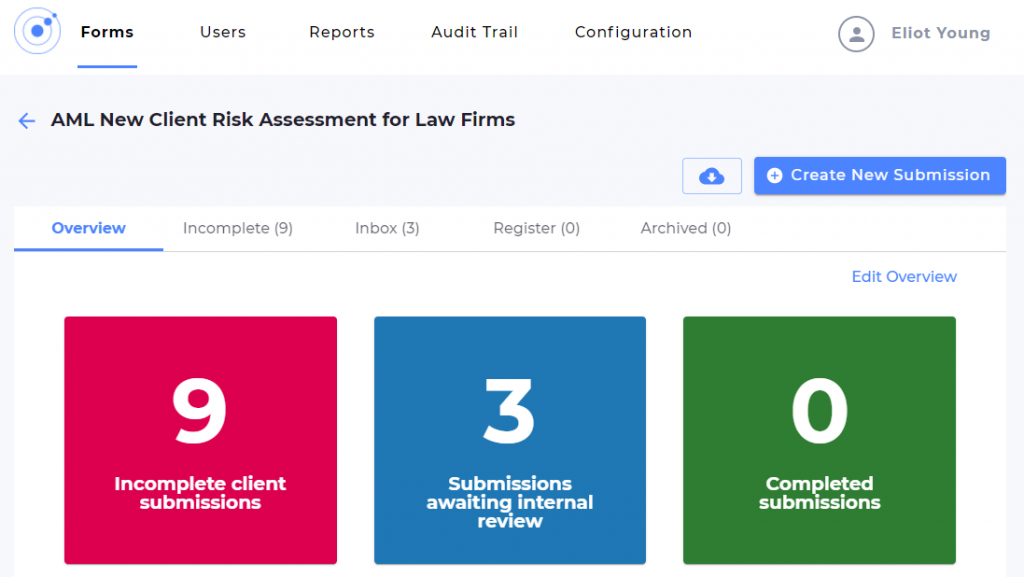

Create a fully customisable dashboard that gives a clear overview of all clients, including where they are located, whether they are a company or an individual, any red flags and more. They can then easily assign a colleague or the client to complete further information.

Rate the level of risk

Based on the answers to the questions in the form, clients will be given a risk level:

- Low risk – the firm can take on the client

- Medium risk – the firm may choose to take on the client, depending on what the risks are

- High risk – the firm cannot take on the client

Why Omnitrack? Key features

- Build your own dashboard – create graphical reports in seconds

- Easily verify documents – documents, such as passports and utility bills, can be uploaded via the questionnaire and verified by the risk team

- Historic timelines – visually review the entire history and future deadlines for individual clients

- Fully integrated with Intapp – we have partnered with Intapp to allow integration with firms’ existing systems

- Dynamic questionnaire – can be completed by either the firm or the client

- Add your own conditional logic to any multiple choice questions in the form

- Includes several workflows for different jurisdictions – the questionnaire adapts as client completes the form

- Link to the Chamber of Commerce to check that the company in question exists

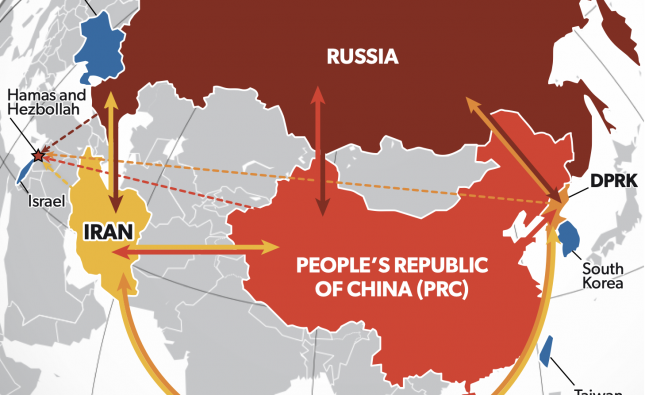

- Firms or individuals from high-risk countries will be required to answer more questions to assess their level of risk

Hosting options

VinciWorks enables clients to take full control of their data by offering multiple hosting options:

- SaaS – Cloud offering hosted by VinciWorks

- Cloud offering with dedicated client database

- On-premises or private cloud hosting

All of these options adhere to strict cyber security standards and all have been successfully implemented. This post details the how and why of hosting Omnitrack on your own servers.

To learn more about our tool, feel free to get in touch by completing the short form below.