+

+

+

+

ASTUTE LMS

Blog

Contact us

About

+

Join our mailing list

COMPLIANCE

ANTI-BRIBERY

ANTI-MONEY LAUNDERING

CONFLICTS OF INTEREST

FCA COMPLIANCE

FRAUD & FAIR COMPETITION

HIGHER/ FURTHER EDUCATION

MODERN SLAVERY

RESPONSIBLE BUSINESS

SANCTIONS

SRA COMPLIANCE

TAX EVASION

WHISTLEBLOWING

HEALTH & SAFETY

EMERGENCY RESPONSE

ENVIRONMENTAL SUSTAINABILITY

FIRE SAFETY

FOOD SAFETY

HAZARDOUS SUBSTANCES

HEALTH & SAFETY FOR DUTYHOLDERS

SAFEGUARDING

SITTING, POSTURE AND LIFTING

SPECIALIST ENVIRONMENTS

VEHICLE, PLANT & EQUIPMENT SAFETY

WORKPLACE SAFETY

PERFORMANCE & LEADERSHIP

COMMUNICATION

CUSTOMER SUPPORT / CUSTOMER SERVICE

DIFFICULT & SENSITIVE CONVERSATIONS

DISCIPLINARY AND GRIEVANCE

HEALTHY LIVING

MAXIMISING PERFORMANCE

MENTAL HEALTH

PERSONAL EFFECTIVENESS

RECRUITMENT

STRESS

INFORMATION SECURITY AND DATA PROTECTION

ARTIFICIAL INTELLIGENCE

CYBER SECURITY

GDPR

GLOBAL DATA PROTECTION BEST PRACTICE

INFORMATION SECURITY

UK GDPR

US DATA PRIVACY

AML CLIENT ONBOARDING

ANNUAL DECLARATIONS

COMPLAINTS

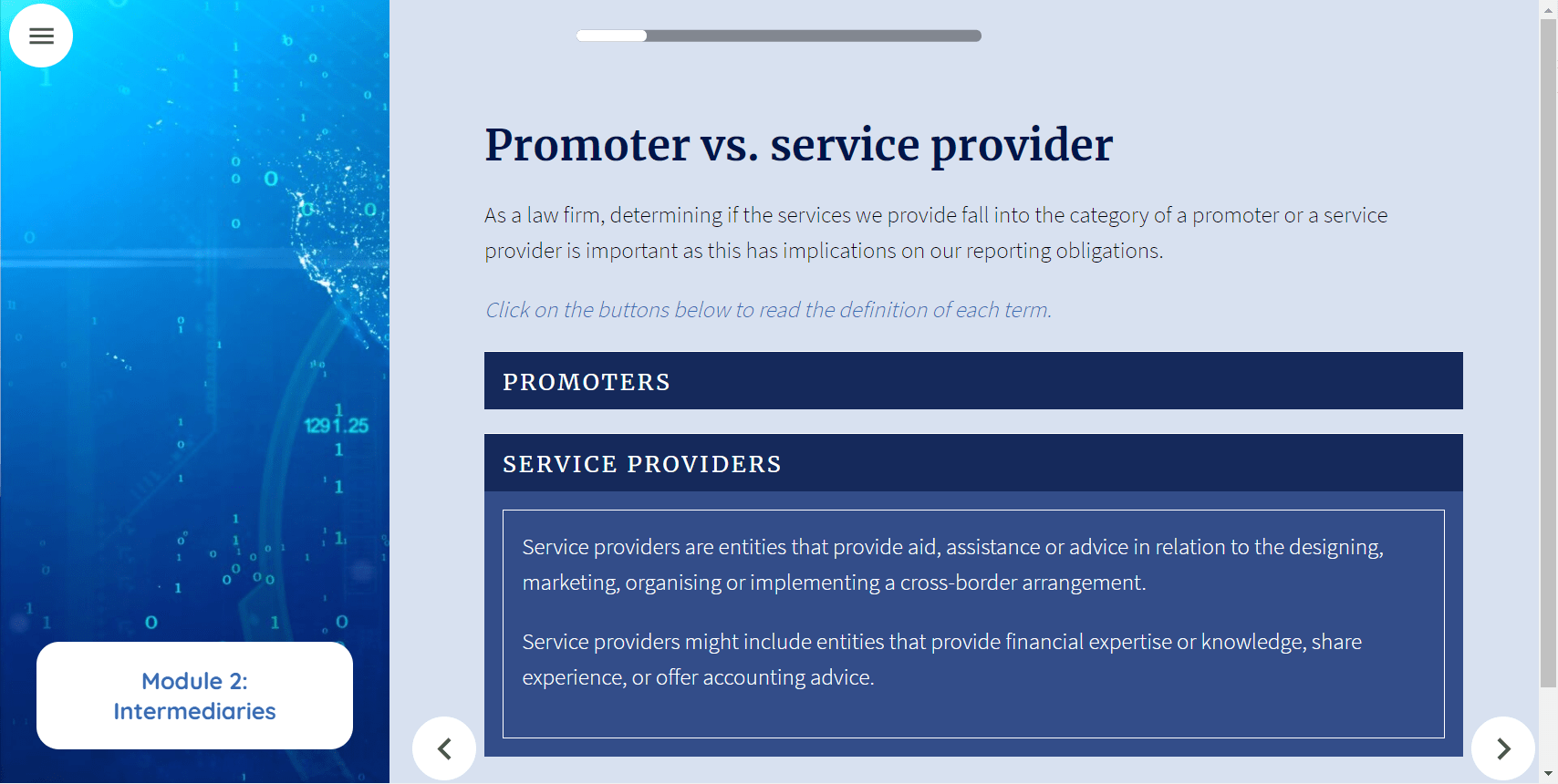

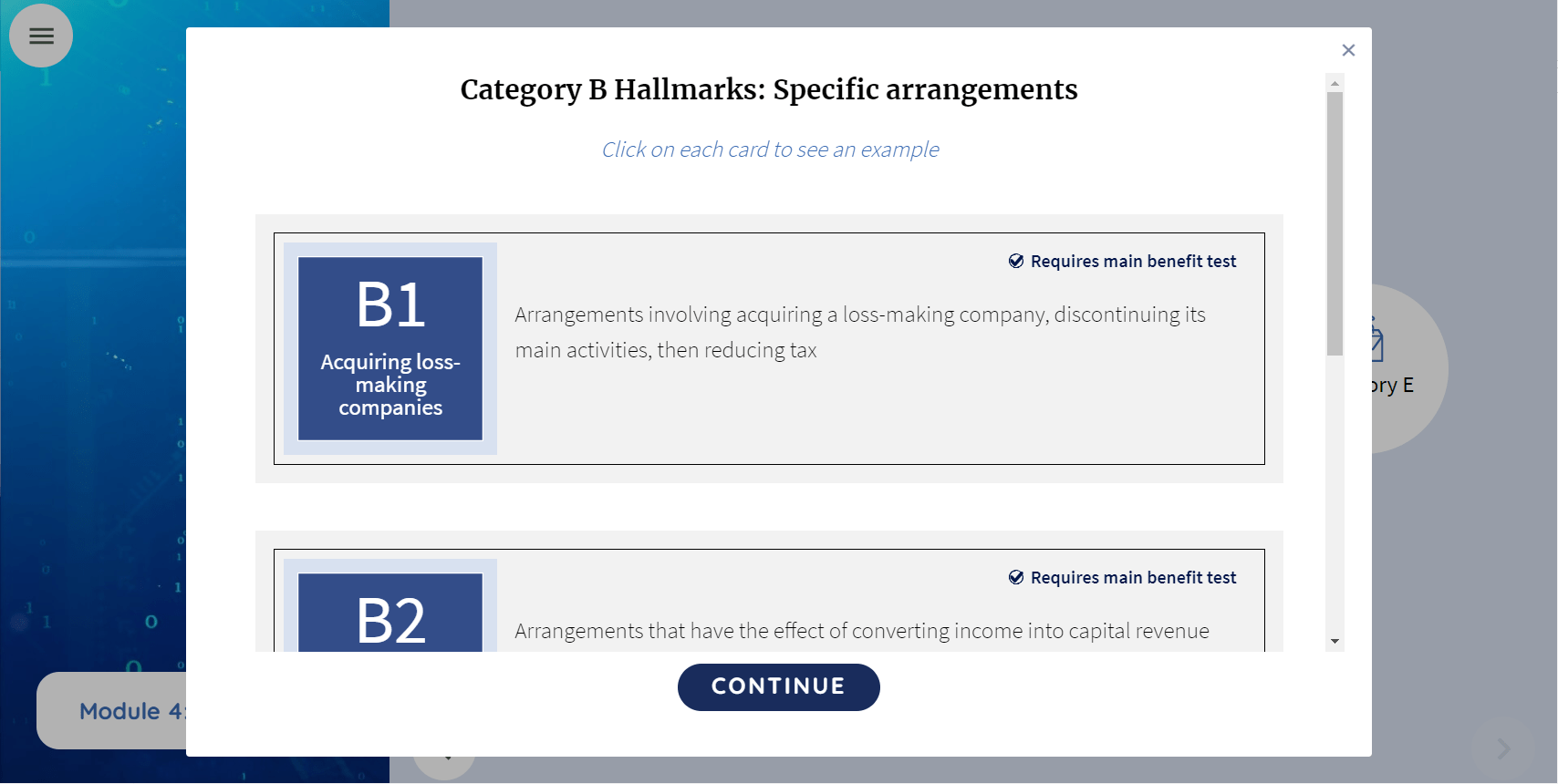

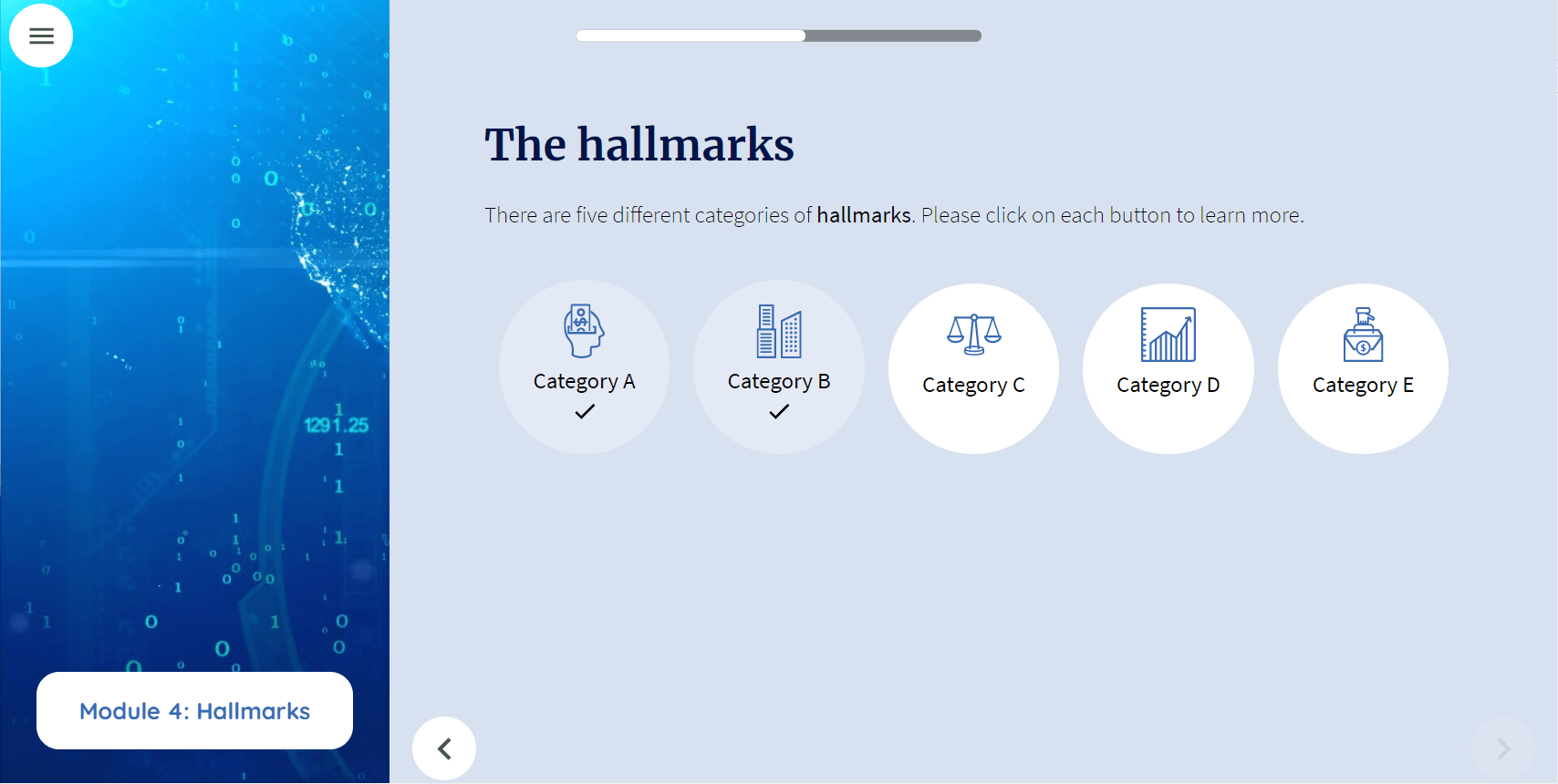

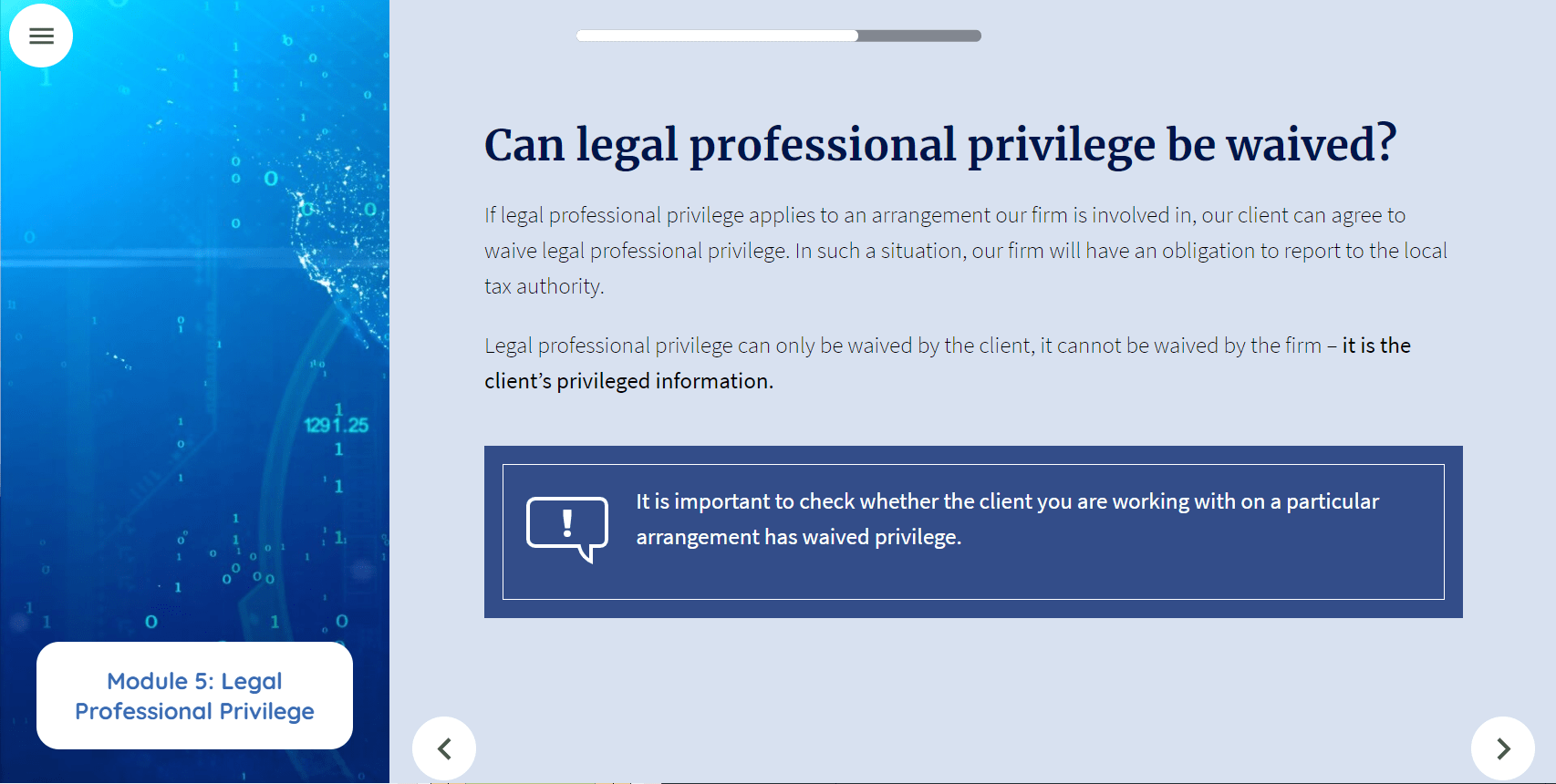

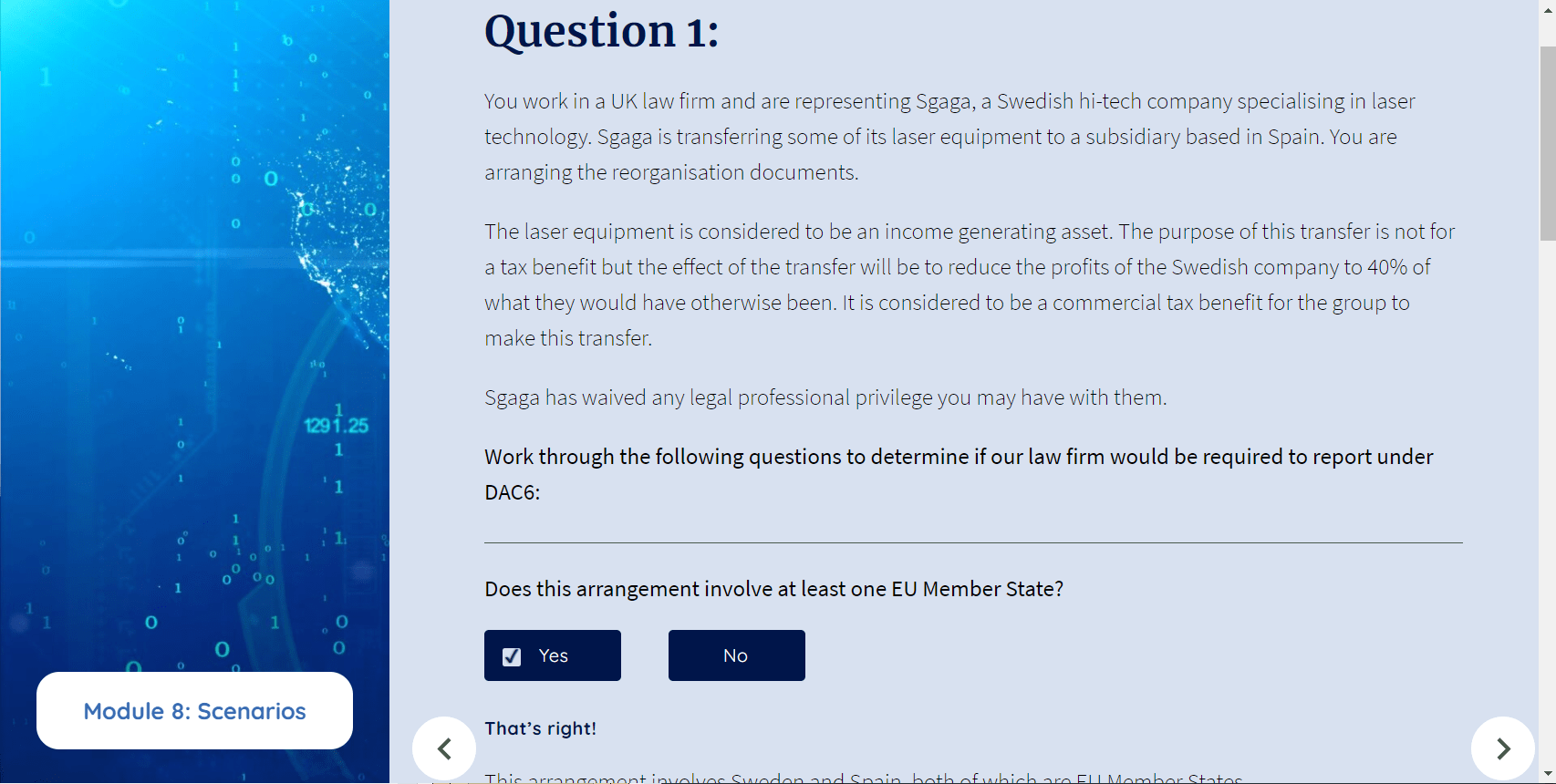

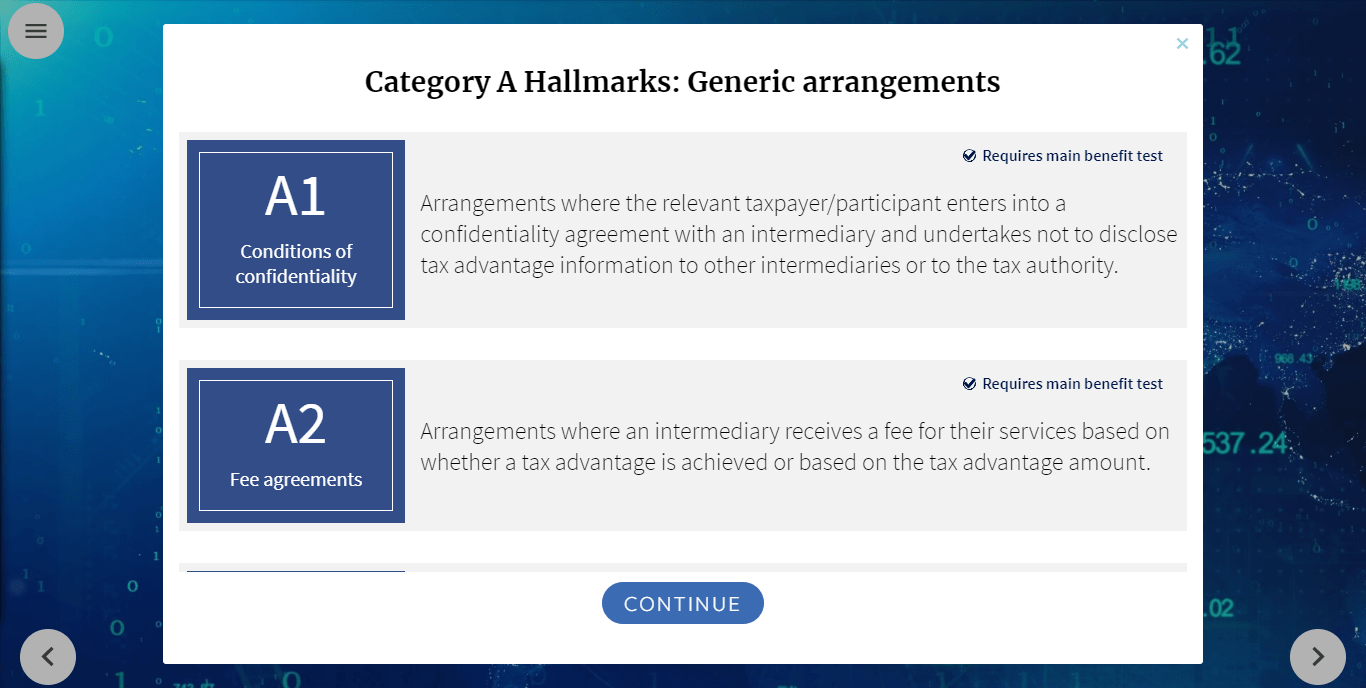

DAC6

DIVERSITY QUESTIONNAIRE

FCA

GDPR

GIFTS & HOSPITALITY

HSE INCIDENT REPORTING

HUMAN RESOURCES

DEUTSCH

DEUTSCH ENGLISH

ENGLISH