VinciWorks has just completed an update to its Anti Money Laundering eLearning course.

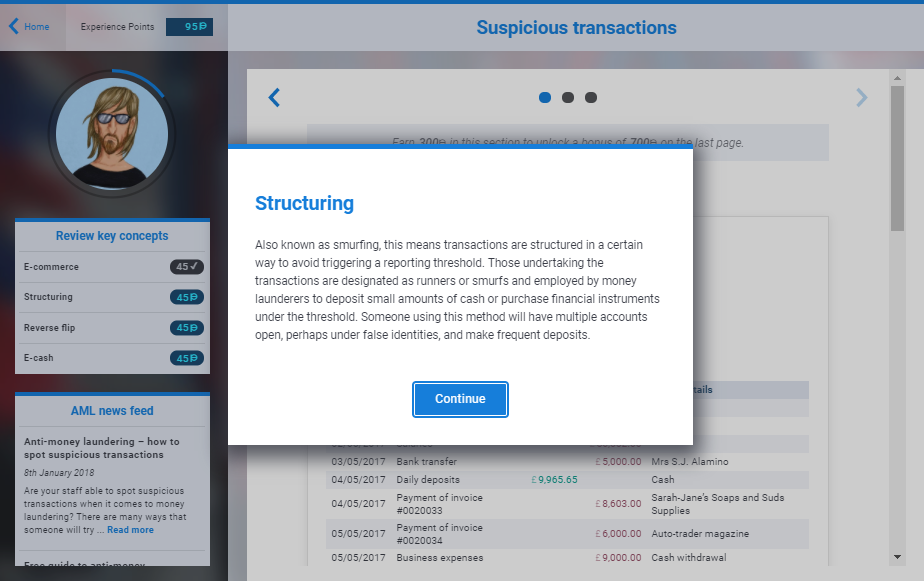

The course which was first launched in February 2017, defines the term Money Laundering and explains the different forms Money Laundering can take. It effectively highlights how criminals can target organisations and describes what should be done if illegal activity is suspected.

The recent fines of £6.2 Million levied on a leading high street bookmaker have brought the issue of Money Laundering back into the public eye. This follows events last year which saw the bookmaker return £500,000 to a Scottish council when it failed to spot £1m that was stolen and gambled through them by a council employee.

Completion of this course helps enable employees to identify the possible signs of Money Laundering. Factors such as business type, suspicious behaviour, payment patterns and geographical location are all addressed.

This interactive Anti Money Laundering eLearning Course course covers the following areas:

- Enables users to understand the importance of regulatory bodies and what regulations are in place.

- Describes the Financial Action Task Force (FATF)

- Explains the significance of the Proceeds of Crime Act (PCA).

- The importance of the National Crime Agency (NCA) is explained, the significance of risk assessments and need for a Money Laundering Reporting Officer (MLRO).

This course highlights the various stages of Money Laundering, including placement, layering, integration and payment methods. It discusses how to ensure your business is dealing with a legitimate organisation or individual. The four stages of Customer Due Diligence (CDD) is explained and what to do if you need to report suspicious activity.

The update, prepared in conjunction with the Regulatory Team of Reynolds Porter Chamberlain LLP, includes additional optional content for people working in regulated sectors but is also applicable to anyone who handles money at work.

Looking for more in-depth and engaging business protection training courses? Explore our comprehensive eLearning library and try any of our courses for free.