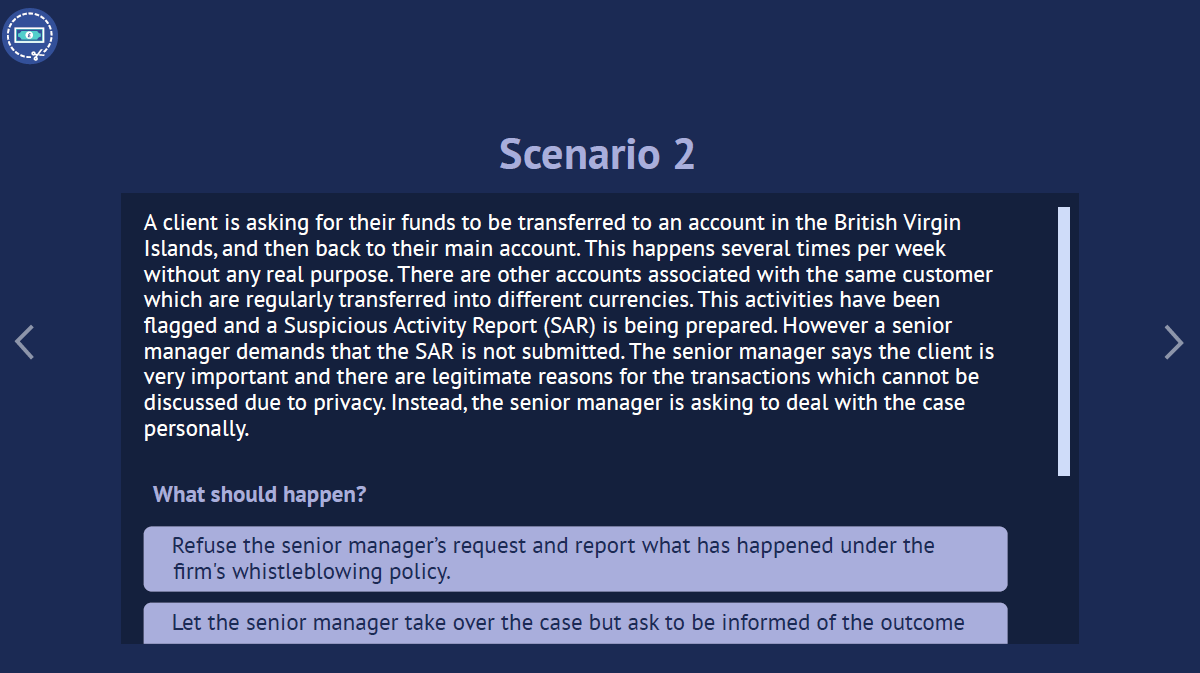

VinciWorks has released a new e-learning course on tax evasion. The course will teach employees how to spot tax evaders, and the reporting procedures required of them. The training will cover the organisation’s policies and procedures, which include provisions of The Act and any other regulatory rules and principles. This includes:

- An explanation of when and how to seek advice and report any concerns or

suspicions of tax evasion or wider financial crime, including whistleblowing

procedures - An explanation of the term ‘tax evasion’ and associated fraud

- An explanation of an employee’s duty under the law

- The penalties relating to the person and corporate entity for committing an

offence under The Act - The social and economic effects of failing to prevent tax evasion

Training on tax evasion is a requirement of the new Criminal Finances Act, passed by Parliament on 27th April 2017, which creates a new corporate criminal offence for failing to prevent the facilitation of tax evasion.

The Act will place responsibility on businesses to make sure none of their employees are involved in helping someone evade their taxes.

Free course demo – Tax Evasion: Failure to Prevent

VinciWorks is offering a free demo for the upcoming course on tax evasion. The demo gives users an opportunity to see how interactive the course is and is completely mobile friendly.

Fill in the form below to receive exclusive updates about the course.