Fleet Safety can play a part in accident reduction

According to the Department of Transport, 1,770 people were killed in road traffic accidents in 2018, with 165,100 casualties of with injuries all levels of severity. Although road safety is improving, with vehicle technology and advances in road engineering being contributing factors, poor driving behaviour still causes accidents and shatters lives. What role does fleet safety need to play in reducing this further?

For organisations whose workforce drive to business appointments, whether in a company vehicle or private car, poor road safety can have huge financial and reputational implications not to mention, costly legal fees. Driving during the working day is possibly one of the riskiest activities an employee will undertake.

So, how can you protect your drivers and your organisation’s motoring budget?

As employers, you have a legal, moral and social responsibility to improve driver safety, hence improving the safety of your employees and the general public. Managing road risk can also have positive financial benefits. For example, road traffic accidents can cost your organisation increased insurance premiums, lost productivity and revenue, damaged stock and possible sick leave. Reducing accidents by raising awareness can thus, improve your business’ motoring budget.

As employers, you have a legal, moral and social responsibility to improve driver safety, hence improving the safety of your employees and the general public. Managing road risk can also have positive financial benefits. For example, road traffic accidents can cost your organisation increased insurance premiums, lost productivity and revenue, damaged stock and possible sick leave. Reducing accidents by raising awareness can thus, improve your business’ motoring budget.

Implementing a straightforward Driving Policy is paramount. Your policy should be produced in consultation with managers and your health and safety officer. Furthermore, your company policy must include your organisation’s health and safety statement.

It should be communicated to and agreed by your workforce. When rolling out your policy to employees, it is important to ensure that you have a robust audit trail of who has read and agreed with the policy. It is also important to show that employees have understood the policy. WorkWize from Vinciworks can fully automate this process, pushing the policy out to employees to sign off using a digital signature. WorkWize also includes a test on the policy to prove understanding. This is all reported back in a comprehensive Compliance dashboard.

Procedures and guidance should be available in an employee’s handbook, providing information on vehicle safety and maintenance, journey planning, a mobile phone policy, an alcohol and drugs policy and advice on the use of satellite navigation devices. Additionally, procedures on what to do in the event of an accident should be included with all relevant reporting forms and line manager contact details.

Rolling out a system of driver assessment and training is an effective way of demonstrating the importance of road safety and highlights how different behaviours can contribute to road accidents.

Rolling out a system of driver assessment and training is an effective way of demonstrating the importance of road safety and highlights how different behaviours can contribute to road accidents.

VinciWorks offer an Online Driver Safety Training course designed to highlight how driver behaviour can impact road safety, for themselves and for other drivers. The online course explains how accidents can be caused by how the driver behaves, including failing to observe rules of the road, not paying enough attention or being distracted. It details the responsibilities each driver has each time they use a public highway and covers the legal requirements within the UK for ensuring that vehicles are roadworthy.

The course can be fully customised to meet the needs of your organisation. A designated course administrator can edit the text and images within the course, and link to organisation-specific documentation, all at no extra cost.

Looking for in-depth and engaging health and safety training? Explore our comprehensive eLearning library and try any of our courses for free.

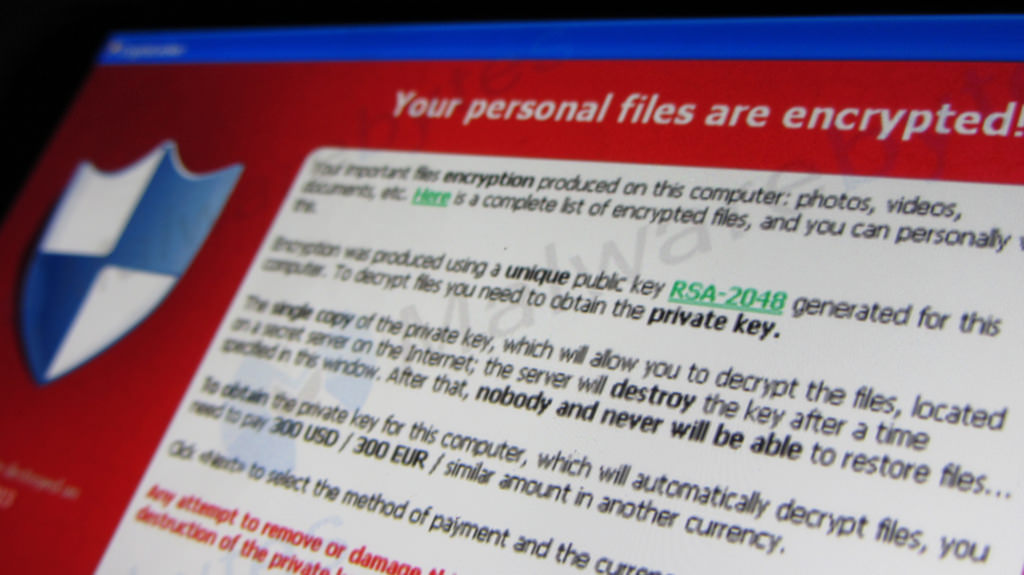

Anyone can be a target. Criminal gangs attack individuals, small businesses and large corporates, in equal measure, seeking to profit from compromised data.

Anyone can be a target. Criminal gangs attack individuals, small businesses and large corporates, in equal measure, seeking to profit from compromised data.

“These crimes must be stopped and the victims of modern slavery must go free. This is the great human rights issue of our time, and as Prime Minister I am determined that we will make it a national and international mission to rid our world of this barbaric evil.”

“These crimes must be stopped and the victims of modern slavery must go free. This is the great human rights issue of our time, and as Prime Minister I am determined that we will make it a national and international mission to rid our world of this barbaric evil.”  , effectively delivers the information needed to ensure your employees can recognize the key signs in an emergency situation.

, effectively delivers the information needed to ensure your employees can recognize the key signs in an emergency situation.